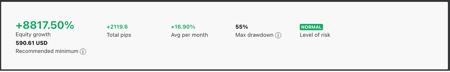

With an average per month return of 16.90% and a max drawdown of 55%, this SP is suitable for you if you are looking for some high-risk plays.

One thing to note is the recommended minimum of USD590.61. While it is best to have your capital be as close to the recommended minimum as possible, there are ways to follow SPs that have the recommended minimum amount that is far from what your capital is. Under settings, you can set a fixed lot size or restrict the number of trades opened.

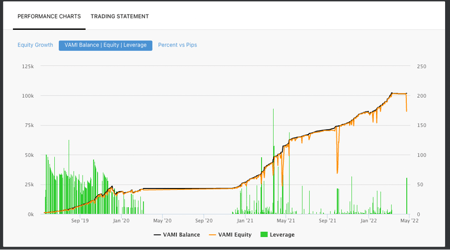

This SP has been running since May 2019 with only 3 months of losses. Hence, it is impressive.

As we are looking at the VAMI Balance versus Equity and Leverage, you can see that they stick to their lot size strictly. However, if you notice the orange spike downwards, this reflects that they do hold some of their trades into steep losses before closing them at either breakeven or in profit.

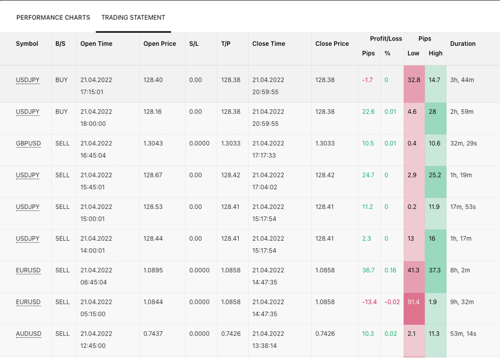

In the trading statement, we can tell that they do not set a stop-loss, which is a red flag. We can resolve this by going into advanced settings and setting a fixed stop loss and forced exit and stop to protect your capital if this SP goes rogue at any point in time.

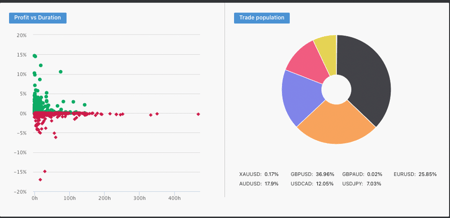

Finally, the “Profit vs Duration” chart shows that this SP is an intraday trader. Do note that the CopyPip platform charges a 0.7 pip commission for every trade taken so SPs that scalp are usually not recommended.

Fullerton Markets Research Team

Your Committed Trading Partner