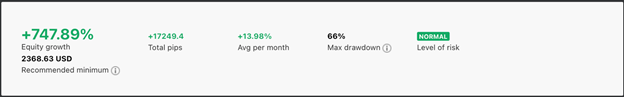

For this week’s copy tip of the week, we will have a look at strategy provider (SP), “Rollo”. As seen from their profile, this SP is from Belarus. The first statistic I noticed is that their maximum drawdown is 66%, putting them as a high-risk SP immediately.

Equity growth of 747.89% does not indicate much as it would depend on the duration this SP has been running. Similarly, the total pips do not tell a full story, as scalpers will win in the total pips, but lots size plays a huge difference in terms of profit.

This SP incepted with a total of 1 year 3 months in the running since March 2020. What surprised me is that so far, they have only 1 month of negative returns, which is impressive. Their YTD returns for 2020 came in at 473.96%. This means that if you invested 1000 with SP “Rollo”, you would have multiplied your account by about 4.7 times.

As we move on to this SP’s trading statement, it is apparent that they do not have a stop loss in place. I have explained this in the past video on how to spot SPs who are not using a stop loss. I have always recommended clients to set a fixed stop loss through the advanced settings when following any SPs. This is to create an additional safeguard for you as the strategy follower.

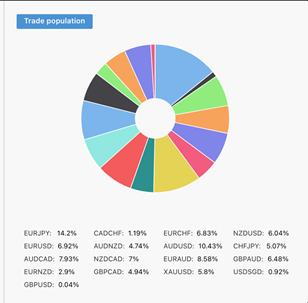

This SP is also a dynamic trader who does not focus on any specific trades. Therefore, they will be very actively trading as opportunities arise from the various trading pairs.

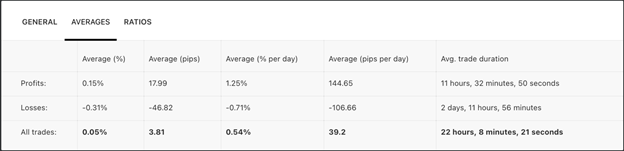

Finally, their average pips per trade came in about 17.99 pips, which is fantastic, as this would mean the 0.7 pips commission charge by CopyPip will not greatly affect the PnL.

One thing to note is that, even though their average losses at -46.82 pips may seem counterproductive, you must understand that the profitability ratio should come into play to make the average profit or loss wholesome. If their profitability ratio is 70% (e.g., out of 100 trades, they win 70 trades), this would mean that even though their average profitable trades have low pips, the trading account will still be profitable at the end of the month.

Fullerton Markets Research Team

Your Committed Trading Partner