Today we re-evaluate strategy provider “FirmumFidusciamMotus”.

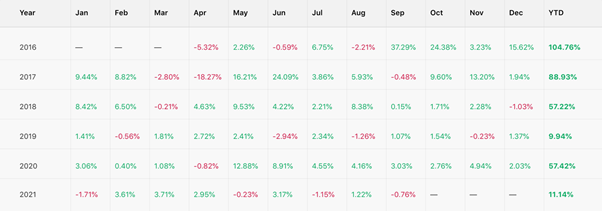

We reviewed them in September 2020 and since then, their equity growth has gone from 857.04% to 1069.9%.

Furthermore, their average profit and max drawdown remained the same, which shows that they are still trading stably, with low risk for the past 1 year.

To date, they are at an 11.14% YTD. This is an acceptable profit for a long term trader.

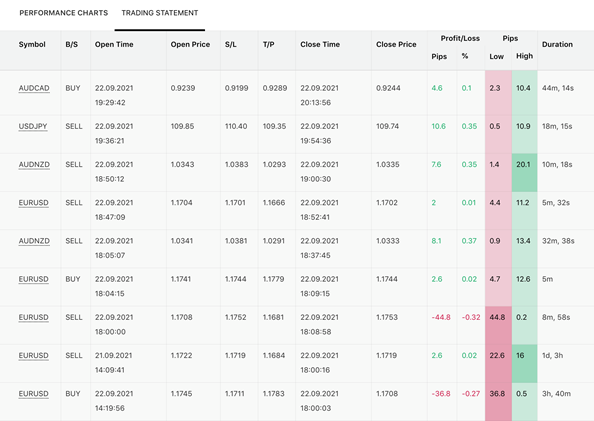

If we look at their trading statement, all their trades have SL and TP levels. The risk management of this Strategy Provider gives their Strategy Followers the added confidence.

Lastly, their average profit is 1.76 pips. Considering CopyPip’s 0.7 pip commission, this provider does not have a large safety margin. Nonetheless, they are still a good provider to follow. Their trading records in the long term remain safe and stable.

Fullerton Markets Research Team

Your Committed Trading Partner