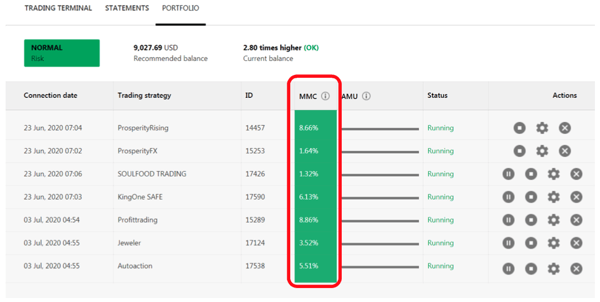

Money Management Correlation is an indicator under “Portfolio” which shows conformity of your settings in a specific trading strategy to Money Management rules defined by a strategy provider.

MMC gives you the percentage of risk that you are taking based on the settings and lot size determined by you. Any value more than 100% is putting the account at risk and could cause a forced closing of position or a stop out.

There are two ways to reduce the percentage of risk with MMC:

- Reduce the lot size traded under settings

- Fund your trading account

All in all, we should adjust the MMC percentage such that all your strategy providers’ accounts sum up to 100%. For example: If a follower is following providers A, B and C, the MMC value could be 33.3% each to make up to 100%.

Fullerton Markets Research Team

Your Committed Trading Partner