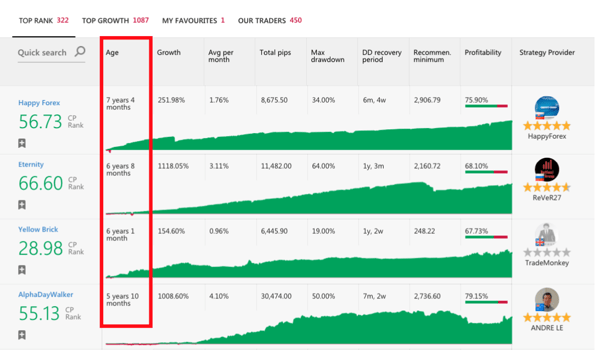

1) Look for traders with a proven track record of at least 12 months on the social trading network. The longer the better, as this allows you to evaluate the performance of the trader during different market condition (bull and bear markets).

2) Look for traders who deliver consistent results over time. A trader delivering 3% (or 200 pips) each month over 12 months is much more consistent than a trader with 6 winning months of 10% (or 600 pips) and 6 losing months of 7% (or 200 pips). When you look at the historical performance graphs, consistency is demonstrated by a gradual increasing graph. Graphs with irregular spikes are signs of less consistent traders.

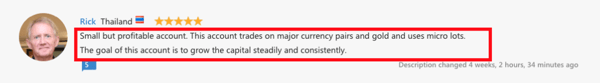

3) Look at the trader’s trading strategy and profile description. Is there a clear strategy? Is this an individual trader or a trading firm? Is it clear if the trader is using automated trade signals or are they trading manually?

4) Does the trader set stop levels on each open trade? If yes, at what level? Setting stop levels/stop loss is crucial in managing the risk of a trade (i.e. maximum loss). The distance of the stop levels determines the level of risk. No stop level means potentially unlimited risk.

5) Review the closed trades of the strategy provider and look for the average pip size of the gains and losses. If these are fairly small, you need to consider about slippage, which means your actual result will be significantly different from the result of the trader. For example, if your slippage is 1 pip, and a trader makes 2 pip profit per trade, your returns will be 50% less than theirs. However, if they make 10 pips per trade, your result will be 90% of theirs.

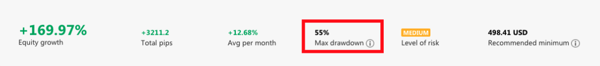

6) Look at the historical drawdown of the trader and identify how much their account has been negative. You can use this as a guide to predict that in the future, this trader will experience at least the same amount of drawdown and probably even more, if they use the same strategy.

7) When you’re looking to spread your risk by following different traders, make sure you compare their strategy and historical trades first. If these two traders follow a very similar strategy, diversifying your strategy like this wouldn’t really help spreading the risk.

Fullerton Markets Research Team

Your Committed Trading Partner