China’s PMI fell further in September, short AUD/USD?

China’s PMI shows slower growth which will worsen as tariffs continue to weaken export orders

China’s official manufacturing PMI undershot expectations in September, falling to 50.8 from 51.3 in August. This is significantly below the consensus forecast of 51.2 and is the lowest reading in the last seven months.

The value is consistent with the weakening Caixin PMI, which also saw a big fall to 50 from 50.6 in August which is below the consensus forecast of 50.5. The Caixin survey covers China’s export-oriented firms, which makes it a good gauge of the conditions in the export sector. The weakness reflected sharp deterioration on the external front. The export orders sub-index of the official manufacturing PMI – the key indicator that gauges the impact of the US tariffs – tumbled to 48.0 from 49.4 in August. It remained in the contraction territory for the fourth month in a row. New export orders in the Caixin PMI also saw a sharp decline.

Downward pressures from the external sector will become more intensive. The latest 10% US tariffs on $200 billion worth of imports from China were only effective in the last few days of September but are expected to deal a heavier blow to Chinese exporters in the following months. We estimate the existing tariffs to reduce China’s growth by 0.5%, compelling China to place a forceful policy support to cushion the blow.

Fed confident on its economy, all eyes on jobs report this week

Fed officials are feeling optimistic about the economic outlook based on the forecast adjustments adopted at the September FOMC meeting. The summary of economic projections shows growth stretching even further above trend in 2018 and 2019 relative to previous expectations and continuing above trend in 2020. As a result, policy makers are increasingly confident that a December rate hike is viable, and about 125 additional basis points of tightening are warranted over the medium term.

This Friday’s jobs report will focus on signs of wage inflation since average hourly earnings touched a cyclical high in August. However, the clarity of the signal from the jobs report is set to fade as Hurricane Florence is poised to impact the pace of job creation beyond September. This will likely distort average hourly earnings and the average length of the workweek temporarily.

Our Picks

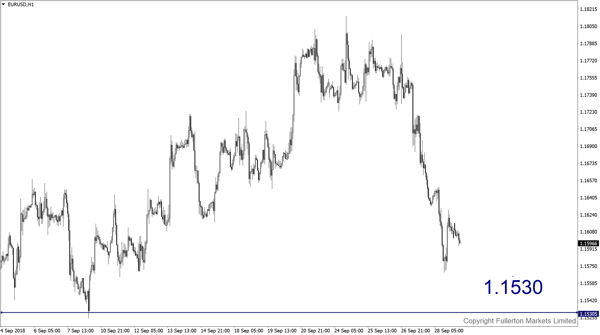

EUR/USD – Slightly bearish.

This pair may drop towards 1.1530 as the eurozone’s latest economic data showed sign of weaker growth.

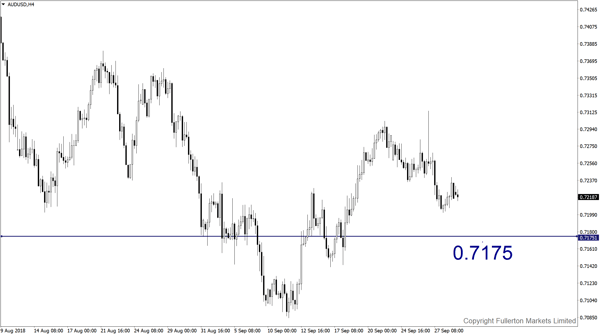

AUD/USD – Slightly bearish.

China’s soft PMI may drive the pair even lower towards 0.7175.

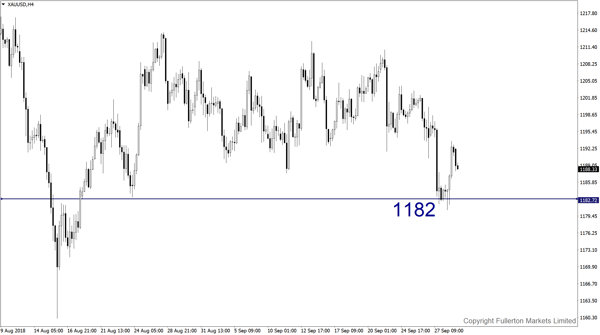

XAU/USD (Gold) – Slightly bearish.

We expect price to fall towards 1182 this week.

Fullerton Markets Research Team

Your Committed Trading Partner