China’s PMI fell further in September, short AUD/USD?

China GDP hints that more RRR cuts may come which is bad for EM currencies

China’s GDP growth came in at 6.5% year-on-year in 3Q, in line with our forecast. The consensus estimate was for a 6.6% reading. This was down from 6.7% in 2Q and marked the slowest pace since 2009. The slowdown was driven by weakness in the manufacturing sector which caused growth in the manufacturing sector to decelerate to 5.3% from 6% in 2Q. On the other hand, growth in the primary and tertiary industries edged up.

China’s growth slowed further in 3Q and we saw more weakness heading into year-end as the trade war impact becomes more visible and supportive policies will take time to kick in. There was a slight pickup in investment though retail sales growth was broadly flat after considering higher inflation, based on our estimates. Industrial production slowed more than expected. The gradual slowdown at this point gave little comfort as policy easing had yet to stabilise growth. While growth might decelerate gradually, the government’s target of 6.5% for the year should be within reach. The authorities are likely to strengthen the policy’s support to buttress the economy.

Another cut in the reserve requirement ratio by year-end is possible, following a recent one-percentage-point reduction. On the fiscal front, the government is likely to continue to push on the accelerator on infrastructure investment. Financial regulators are already offering verbal support to financial markets, and a pronounced rise in the Shanghai Composite prompted chatter about state-backed buying.

Looking forward, we expect moderate deceleration in growth to extend into 4Q. Economic activity, particularly non-infrastructure-related investment, is likely to be weighed down by a slow credit expansion. On the external sector, the impact of the trade war is likely to gradually become more evident as front-loading in shipments fades. Our estimates suggest that the US tariffs on $250 billion worth of imports from China could reduce China’s GDP growth by about 0.5 percentage point in absence of policy countermeasures. We expect policy support to be stepped up. The PBOC recently cut the reserve requirement ratio by one percentage point, and one more RRR cut is expected before year-end.

On the US side, a summary of the 25-26 September FOMC meeting was released last Wednesday which pointed to a continued willingness by the US central bank to gradually increase its interest rates. Its economic growth surged to 4.2% in the second quarter, the fastest since 2014, and is projected to come in above 3% for the July-September period. This was driven by consumer spending and business investment that has been juiced by Republican tax cuts. The labour market is tight, so the dollar has little driver to move lower.

Our Picks

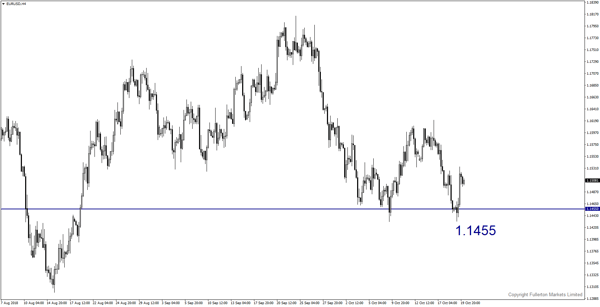

EUR/USD – Slightly bearish.

This pair may drop towards 1.1455 as Trump may unveil new tax-cut measures positive to the dollar.

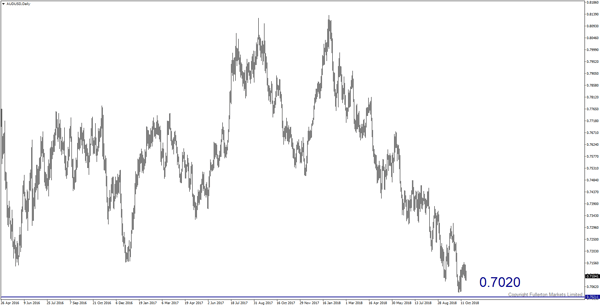

AUD/USD – Slightly bearish.

China’s below-estimated 3Q GDP will continue to pressure Aussie further lower towards 0.7020.

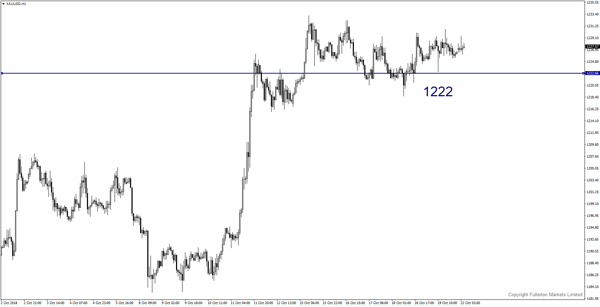

XAU/USD (Gold) – Slightly bearish.

We expect price to fall towards 1222 this week.

Fullerton Markets Research Team

Your Committed Trading Partner