Brexit headlines continues to overshadow UK’s economic data, Short GBP/USD?

UK’s unemployment rate fell to 4% yesterday which is a 43-year low. Wage growth slowed slightly but jobless claim increased lesser than expected. Sterling rose on the initial jobs data released, but gave up gains as Brexit headlines, market sentiment and risk appetite continue to weigh on the sterling,

Brexit headlines continue to enter into dangerous water as more warnings unveiled that UK could be heading for an outright hard Brexit, or even a no Brexit. Furthermore, UK parliaments Conservative Brexiteers threatened to outright reject any trade deal presented by the Chequers.

We have CPI data to be released later which has the chance of pulling sterling back from the abyss. The main reason why BoE had a rate hike this month was primarily due to price pressures. Thus, if CPI were to surprise the market, we could see sterling rise higher. The markets are expecting an improvement of the CPI from 2.4% to 2.5% this time round.

However, it is also possible that CPI data or inflation in July is unlikely to change the market’s expectations as BoE mentioned during their rate hike that UK is expected to be influenced to the greater extent by domestic price pressures while external pressures including past sterling’s depreciation are expected to fade away.

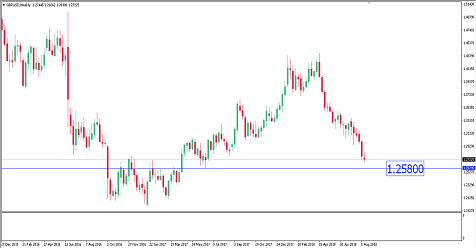

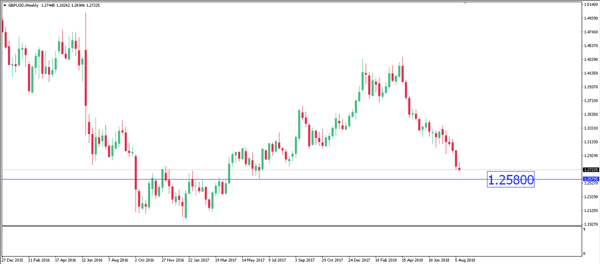

GBP/USD is currently hovering around 1.2700 regions which is proving to be a strong psychological barrier. Even if CPI was better than expected, we could see external risk preventing the currency from having any significant rally. Once 1.2700 price level is broken, we could see 1.25800 as the next major support in sight.

Fullerton Markets Research Team

Your Committed Trading Partner