Fed chair expects a bumpy recovery ahead, long gold and short USD/JPY?

Federal Reserve Chairman Jerome Powell said the US economy will eventually recover from the coronavirus pandemic, but the process could stretch until the end of next year and it depends on the delivery of a vaccine.

Assuming there isn’t a second wave of the coronavirus, market will see the economy recover steadily through the second half of this year, as commented by the US central bank chief in a television interview conducted last Wednesday, parts of which were aired on CBS’s “Face the Nation” and “60 Minutes” shows on Sunday.

For the economy to fully recover, people will have to be fully confident, and that would depend on the arrival of a vaccine, said Powell, seated in the Fed’s stately boardroom at the long table used to deliberate monetary policy.

Some investors in the US money markets are even betting that Fed Chairman Jerome Powell will have to adopt negative interest rates sooner or later, despite him dismissing that idea on Wednesday. He may offer more clarity on Tuesday, when he addresses a Senate committee along with Treasury Secretary Steven Mnuchin. A day later, the US central bank will publish the minutes from its April meeting, when it held rates.

Gold is making a strong start to the week, hitting a fresh high for this year and its best level since 2012. One of the main drivers is the Fed funds contract pushing into negative territory.

As the July 2021 contract pushes further above 100, it is taking gold along for the ride. Jerome Powell is adding fuel to the rally with a warning that the process of economic recovery could stretch through until the end of next year.

The speed and intensity of the virus recession has rendered many traditional economic indicators out of date before they are published.

The overall picture looks slightly less bleak than it did a few weeks ago. Indicators for a number of countries show signs of bottoming out. Focusing on China, the supply side has sprung rapidly back to life. In Germany, there are signs that activity is starting the long climb back to normality.

Traffic levels in the world's major cities have plummeted. Data from TomTom – a location technology company – shows rush hour congestion sharply decrease across major American, European, and Asian cities. Two exceptions to the rule are Beijing and Berlin, where congestion appears to have returned to its pre-lockdown levels. Those are hopeful signs for some countries that the downturn might be as short-lived.

Our Picks

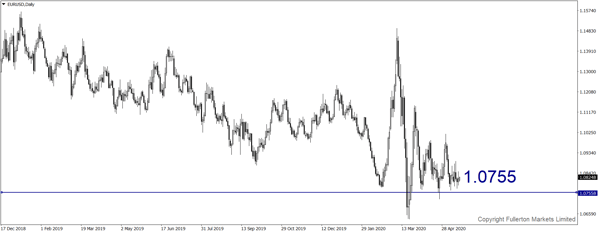

EUR/USD – Slightly bearish

This pair may fall towards 1.0755 this week.

USD/JPY – Slightly bearish

This pair may drop towards 106.50.

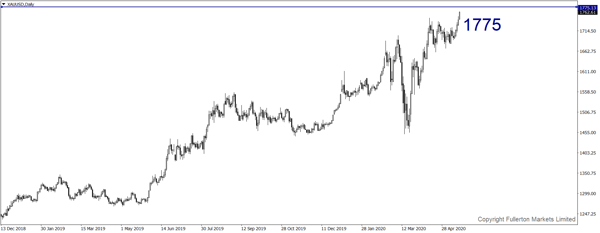

XAU/USD (Gold) – Slightly bullish

We expect price to rise towards 1775 this week.

U30USD (Dow) – Slightly bearish

Index may drop towards 23550 this week.

Fullerton Markets Research Team

Your Committed Trading Partner