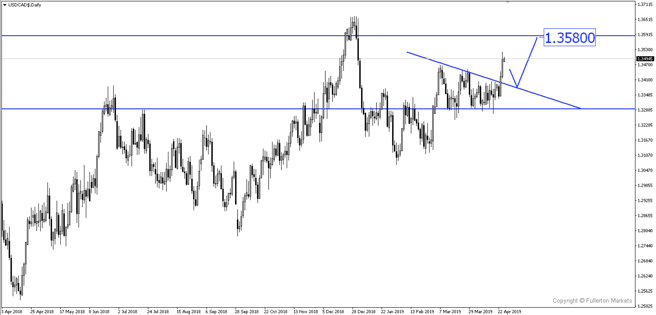

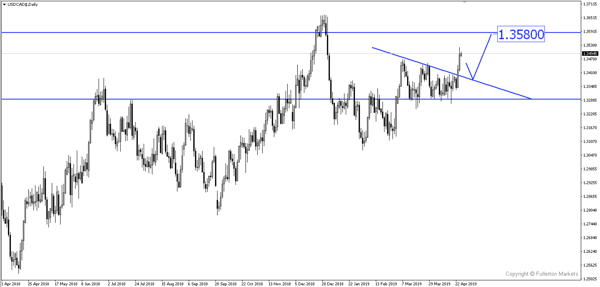

With Bank of Canada (BoC) downgrading their economic forecast and shifting their bias to dovish, Canadian dollar could continue to fall. Long USD/CAD?

Despite improvement in retail sales and trade, BoC followed their central bank peers in lowering economic forecast and dropped their hawkish bias. Retail sales grew to 1.6% from 0.1% while CPI grew to 1.9% from 1.4%. However, all these were not enough to alleviate BoC concerns.

- BoC cited concerns over global growth, housing and even the oil sector, which should benefit from recovery in crude prices. Oil prices could fall soon after the International Energy Agency (IEA) promises to ensure sufficient oil supply.

- They lowered GDP forecast to expand to only 1.2% in 2019, compared to a January estimate of 1.7%. It would be the weakest growth since the 2015-16 period.

- Furthermore, the central bank also erased from their policy discussion any suggestion that interest rates could rise in the foreseeable future, a pivot that suggests the pause that began in December is now on hiatus.

- The yield on overnight index swaps now implies that investors are hedging against the possibility of lower interest rates through next year.

- The only saving grace was Governor Poloz who said that the central bank’s outlook implies that odds still favour increases over cuts. We believe that rates could be held throughout 2019 as the low unemployment rate and almost 2% inflation do not warrant a rate cut.

Fullerton Markets Research Team

Your Committed Trading Partner