US oil prices turned negative as a result of the current global lockdown which is affecting the global demand for oil. With no end in sight, oil prices could remain depressed.

- The price on the futures contract for West Texas crude, which is due to expire today, turned negative – a stunning minus USD37.63 a barrel.

- The main reason for this sharp fall was due to the current COVID-19 pandemic which has led to a global lockdown. This pandemic has brought the economy to a halt.

- Essentially, what negative oil price means is that the oil producers are paying buyers to take the oil barrels off their hands over fears that storage capacity could run out in May.

- Earlier this month, OPEC+ members agreed a record deal to slash global output by about 10%, the largest cut in oil production ever to be agreed. However, analysts said the cuts were not big enough to make a difference.

- The depressed oil prices could affect most oil companies in the industry, especially those laden with debt.

- We believe that this could spark a sell-down in US stock futures soon, due to the negative sentiment in the market.

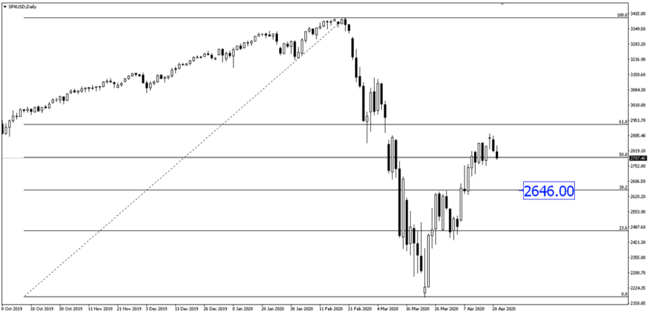

- S&P 500 is current holding at the Fibonacci retracement level of 50%. We believe that once this level is broken, we’d see price falling even lower towards 2646 price level.

Fullerton Markets Research Team

Your Committed Trading Partner