With US interest rates to remain on hold until further notice, dollar could continue to weaken versus commodity currencies such as New Zealand dollar. Long NZD/USD?

- During FOMC this morning, Federal Reserve kept rates unchanged as widely expected. Fed also promised an all-out support for the economy and announced that rates will remain on hold until further notice.

- During Fed President Powell’s press conference, Powell said Fed remain committed to use a full range of tools and continue to use their powers forcefully.

- USD GDP report came out as well and the US economy contracted -4.8% in Q1, worse than market’s expectation of -4.0%. This was the sharpest decline in over a decade.

- The jobless claims will be the main focus tonight as market expects numbers to ease to 3.5 million from 4.42 million from the previous week. If data were to surprise to the upside, dollar could weaken even further.

- We also saw earnings report from a few major companies which pushed US stock futures even higher.

- AMD (Advanced Micro Devices), Starbucks, Tesla and eBay are among the few companies that outperformed in terms of earnings which push stock futures higher.

- However, the market is painting a very optimistic situation that the coronavirus situation will disappear on its own in 6 months.

- Why 6 months? This is because the stock market is looking 6 months ahead at the economy.

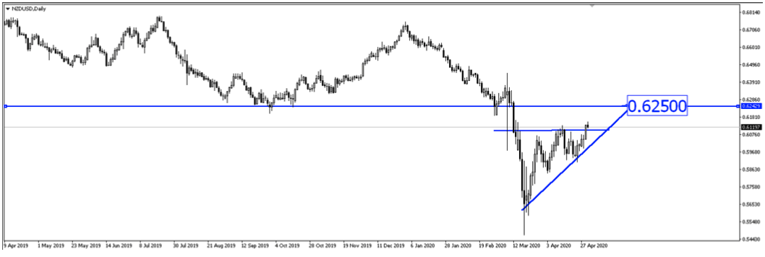

- Lastly, we are looking to long NZD/USD as New Zealand is reopening its economy which would put its economy ahead with the rest of the world which are still in a lockdown.

- NZD/USD could break up higher towards 0.6250 this week.

Fullerton Markets Research Team

Your Committed Trading Partner