Even though both the US and China are optimistic of a possible deal, Trump’s tweet left the market confused. It would be safer to stay on the sidelines.

- Chinese Vice Premier Liu He flew to Washington DC to resume trade talks with US Treasury Secretary Steven Mnuchin and US Trade Representative Robert Lighthizer.

- US President Trump concluded the talks by saying, “We had a very, very good negotiation with China.”

- Given Trump’s reputation, it may be too early to conclude there is progress on the trade talk.

- Day 1 of the trade talk caused risk-off currencies to strengthen after a false rumour from China Morning Post saying that the Chinese ministerial delegation would only stay for one day. This was denied by the White House and reaffirmed by Fox News.

- This was offset by reports from Head of International Affairs for the US Chamber of Commerce Myron Brilliant who said that there could be a currency agreement this week.

- Myron Brilliant also said that both sides agreed to low-level “early harvest” agreements such as currency and copyright protections while bigger deals such as market access and intellectual property remain on the table.

- Trump tweet left the market confused as he said: “Big day of negotiations with China. They want to make a deal, but do I? I meet with the Vice Premier tomorrow at The White House.”

- It is unknown how much progress the trade talk actually made but a limited deal from the negotiations this week will be beneficial to Trump given his impeachment probe.

- We believe that a smart move from Trump would be to settle for limited deals on low-level issues so as to buy some positive press for himself.

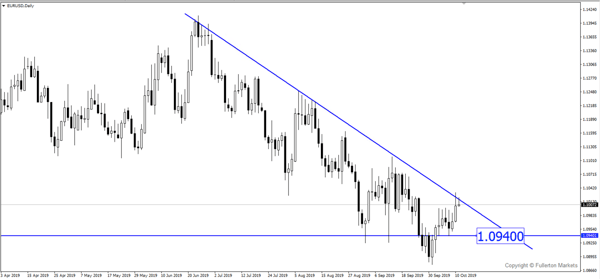

- EUR/USD may be a good pair to short even if a limited deal is made. The upside for EUR/USD could be limited due to the major slowdown in eurozone economy, especially Germany. This pair could fall towards 1.0940.

Fullerton Markets Research Team

Your Committed Trading Partner