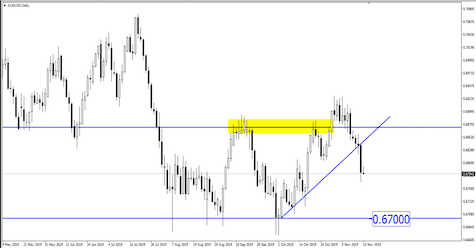

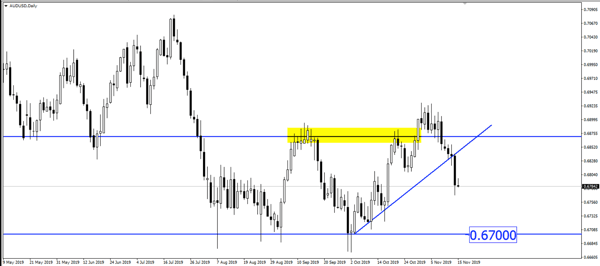

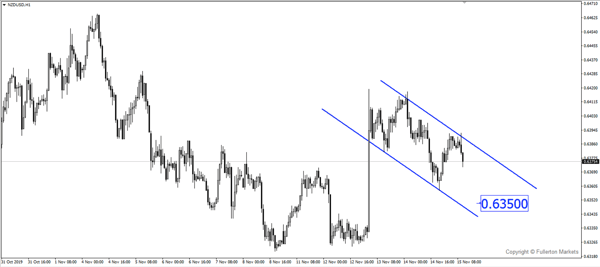

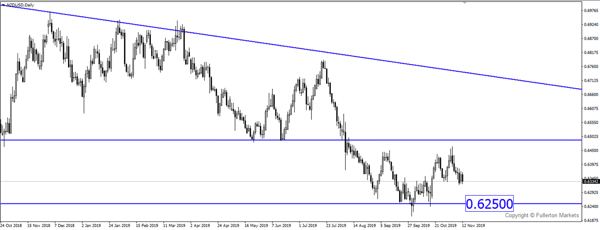

Antipodean currencies continue to weaken despite an improvement in risk sentiments as the slowdown in both Australia and New Zealand becomes evident through data.

Antipodean currencies refer to Australia dollar and New Zealand dollar. Despite the de-escalation of the trade war and improvement in risk sentiments, both Aussie dollar and Kiwi continue to be pressured.

- RBNZ kept rates unchanged on Wednesday this week at 1.00% vs 0.75% which surprised the market as Governor Orr said that monetary policy remains accommodative for now.

- However, he did not mention that this would be the end of the easing cycle and that future rates are data-dependent.

- Aussie dollar, on the other hand, was sold off heavily after its labour data missed forecast by a huge mile.

- Australian jobs contracted by -19K versus a forecast of 16K gain for the first time in more than a year as the global slowdown and continuing tensions between the US and China are finally taking their toll on demand.

- Even though reports have said that the “Phase-One trade talks are in its final stages,” Trump during his speech to the Economic Club of New York on Wednesday seemed to think differently.

- Trump threatened a significant increase in tariffs on China if there is no deal at the end of the day.

- He further mentioned that the EU “in many ways is worse than China” which bring us to focus the US-EU auto tariffs which may happen this week or the next.

- All in all, we feel that risk-on currencies will continue to be pressured until the “phase-one” deal is signed between the two behemoths.

- AUD/USD after breaking its uptrend support could head lower towards the 0.6700 price level.

- NZD/USD after moving higher from a surprise hawkish rate statement could head lower to erase the gains for the week.

Fullerton Markets Research Team

Your Committed Trading Partner