With the surge of a second wave of infections and rise of geopolitical tension in Asia, we could see flows into safe havens. Long Gold?

- A second wave of infection is surging as Beijing authorities ordered all schools closed as they struggle to halt a new outbreak which has already spread to neighbouring provinces.

- In US states such as Texas and Florida are facing a new wave of cases after lifting lockdown orders earlier than medical experts recommended.

- With more countries reopening and easing restriction on air travel, without a proper vaccine, a 2nd wave of infection may be inevitable.

- This could cause another round of lockdowns which will hinder the recovery of the economy and dampen the optimism of the market.

- In addition, geopolitical tensions are also on the rise in Asia.

- We are seeing the conflict between India-China in the disputed Kashmir region over boundary issues while North Korea blew up a joint liaison office with South Korea near the North's border town of Kaesong.

- Twenty Indian troops were killed yesterday in Ladakh which came as a surprise after no bullets flew for four decades.

- On the other hand, the liaison office between South Korea and North Korea was opened in 2018 for both countries to communicate.

- The destruction of the office may be an act of aggression. Last Tuesday, Pyongyang announced it was severing official communication links with Seoul, and over the weekend Kim Yo-jong threatened to send troops into the demilitarised zone (DMZ) at the inter-Korean border.

- All in all, the second wave of infections will continue to weigh on economic recovery while the rise of geopolitical tensions will keep the markets at the sidelines for now.

- In our opinion, sticking with safe havens such as gold will be a safer choice during times like this.

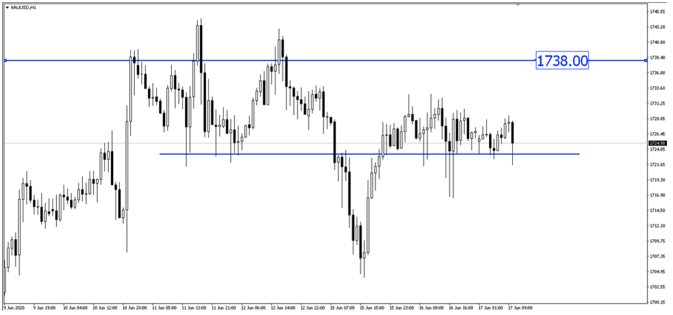

- XAU/USD is currently consolidating at the 1724 price region. We believe that gold could rise higher towards 1738 this week.

Fullerton Markets Research Team

Your Committed Trading Partner