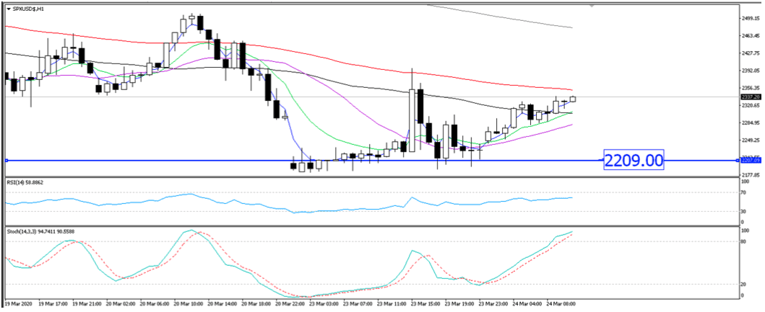

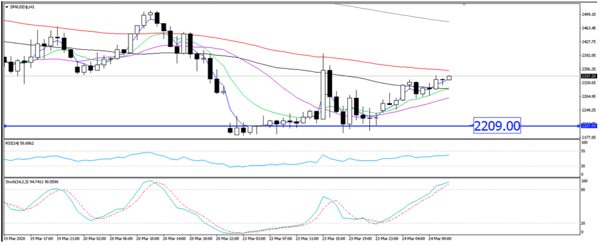

Though Fed will buy unlimited amounts of US Treasuries and mortgage-backed securities in the new QE, it has failed to support the US stocks and weaken the dollar. SPX/USD may continue to weaken.

- In an unprecedented move, Fed launched its new QE whereby they will buy unlimited amounts of US Treasuries and mortgage-backed securities.

- This is an extraordinary backstop for the lending markets that goes much further than what the central bank did in the 2008-2009 crisis.

- Federal Open Market Committee is to buy at least USD 500 billion in Treasury securities and at least USD 200 billion in mortgage-backed securities.

- The move by the central banking system lifted Dow Jones Industrial Average futures, but the index still stumbled by roughly 3% in early trading, sinking below the 19,000 mark within the first 10 minutes.

- However, the aggressive monetary and fiscal stimulus is only an aid, not a cure for the COVID-19 pandemic. The market will continue to weaken and fall until a vaccine is available.

- Furthermore, the Senate also failed to pass a key procedural vote to advance President Trump’s coronavirus stimulus package – as they claim that the USD 2 trillion fiscal package will help businesses more than the average Americans.

- So long as a vaccine is not available, we believe that the SPX/USD (S&P 500) will continue to head lower and any bounce upwards would only be a better opportunity for a short.

- SPX/USD could fall towards 2209 tonight once the US market opens.

Fullerton Markets Research Team

Your Committed Trading Partner