With investors looking past all data weakness and in favour of the economy re-opening and expectations of strong 2H growth, EUR/USD rally could end. Short EUR/USD?

- ECB announced yesterday that it will increase its PEPP (Pandemic Emergency Purchase Programme) by €600 billion.

- This is on top of the current €750 billion of government bond purchases announced in March, bringing the total stimulus to €1.35 trillion..

- The duration of the program has also been extended from the end of 2020 until June 2021, or until ECB feels that the economy has recovered.

- Euro rallied as investors are optimistic with ECB’s effort to support the economy with the expansion of their bond purchases.

- Even though ECB lowered their economic projections, their forecast is not as bad as what the markets feared.

- ECB President Ms Lagarde said there had been a “bottoming out” in economic activity in May but the recovery had so far been “tepid” compared to the speed with which the economy had contracted as the pandemic hit.

- However, if consumer demand does not bounce back as expected, or if the second wave of infections sparked another round of lockdowns, confidence could wane, and more stimulus will be needed.

- Whether EUR/USD could continue its multi-week rally will largely be dependent on the NFP tonight.

- Market is forecasting a 7.5 million job loss, an improvement from the previous month’s 20 million while unemployment rate is expected to spike up to 19.2%.

- Based on the previous economic data during the lockdown, it is likely that market sentiments will triumph over any data. As long as the market sees signs of improvement and with the lockdown easing, dollar should weaken.

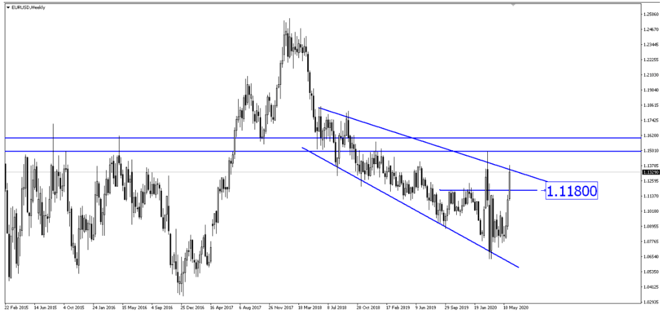

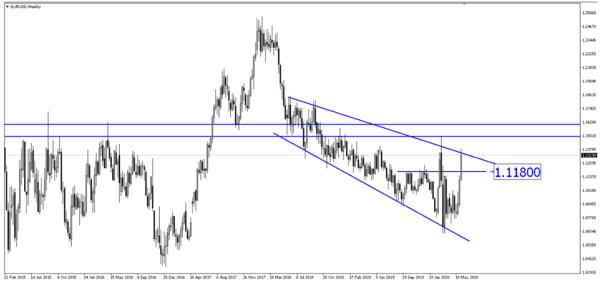

- This could give EUR/USD an overdue correction. EUR/USD could head lower towards 1.11800.

Fullerton Markets Research Team

Your Committed Trading Partner