With US interest rates to remain on hold until further notice, dollar could continue to weaken versus commodity currencies such as New Zealand dollar. Long NZD/USD?

- ECB kept interest rates unchanged, as widely expected, at 0.00% but will step up its effort on its coronavirus stimulus package if needed.

- Furthermore, the bank also announced that it had eased lending conditions for banks. This is by reducing these interest rates further to as low as -1% - effectively paying banks to borrow money.

- The new program is called the Pandemic Emergency Long Term Refinancing Operation (PELTRO).

- ECB President Lagarde is worried that the economy could shrink as much as 12% this year and 15% in Q2. We also saw Eurozone GDP contracting by -3.8% in Q1.

- Euro dollar initially got sold off during the ECB press conference, but recovered strongly into the London close on month-end buying.

- In the longer term, I believe that euro could be weakening further versus its peers due to the following 3 reasons:

- EU is still unable to come out with a unified response to deal with the pandemic and a weakening economy. Countries such as Germany and Netherlands, who are doing better, fear that they will end up with debts from the rest of the countries in the EU.

- Most of the EU countries’ economy were already frail to begin with, before the coronavirus and thus it would take a longer time for them to recover.

- Lastly, after the pandemic, many countries could follow UK’s footsteps and leave the EU after seeing that a unified currency and central bank have more flaws than benefits.

- EU is still unable to come out with a unified response to deal with the pandemic and a weakening economy. Countries such as Germany and Netherlands, who are doing better, fear that they will end up with debts from the rest of the countries in the EU.

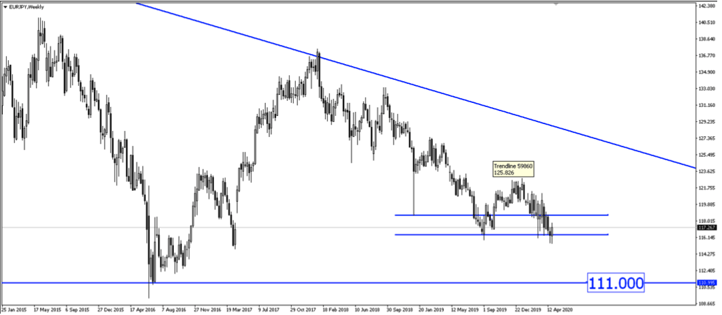

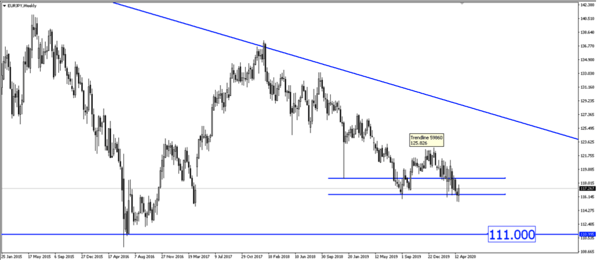

- EUR/JPY spikes higher after the last day of the quarter as institutions started month-end buying. We believe price would fall lower towards 111.00 by the end of this year.

Fullerton Markets Research Team

Your Committed Trading Partner