With ECB President Lagarde showing pessimism on the eurozone economy, we could expect further easing by the ECB next week. Short EUR/USD?

- European Central Bank President Christine Lagarde said the eurozone economy is likely to contract along the lines previously outlined in the bank's medium to severe scenarios, ruling out the "mild" possibility.

- The severe outlook is for a 12% GDP decline and the medium scenario is for an 8% drop, whereas the mild is for a 5% drop.

- The ECB has already unveiled €1.1 trillion worth of bond purchases and loans at deeply negative rates.

- However, analysts expect the ECB to increase its PEPP buy (Pandemic Emergency Bond-Buying Programme) by €375 million next week with some putting the increase as high as €750 million.

- There were also complications whereby reports say the ECB is working on plans to continue QE without German Federal Bank Bundesbank.

- In the worst-case scenario, the ECB would likely launch infringement procedures against the Bundesbank if it stops buying bonds under the QE program.

- This is crucial because QE without Bundesbank could spell the end of EU with countries looking to follow UK’s footsteps in exiting the European Union.

- All in all, we expect ECB to increase PEPP which could limit euro gains next week.

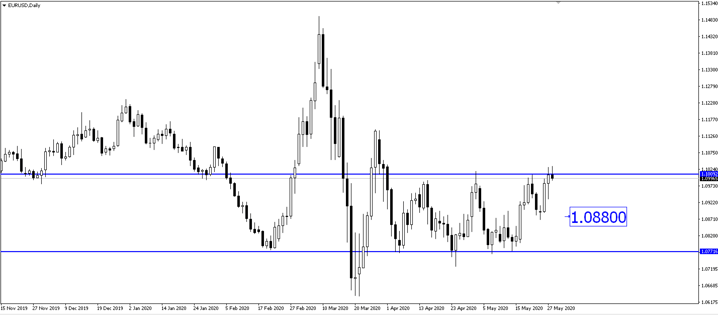

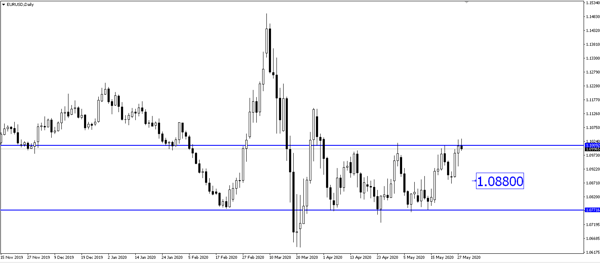

- EUR/USD broke above 1.1000 this week but resistance could be strong and the upside might not sustain. EUR/USD could retrace lower towards 1.0880 next week.

Fullerton Markets Research Team

Your Committed Trading Partner