With the World Health Organisation declaring the COVID-19 situation a pandemic and major central banks cutting rates, the sell-down may be far from over. Dow could fall further.

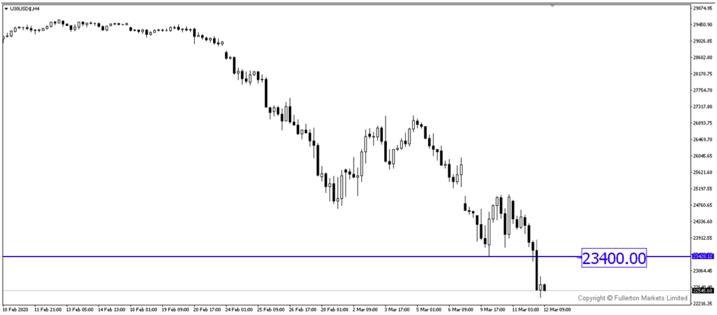

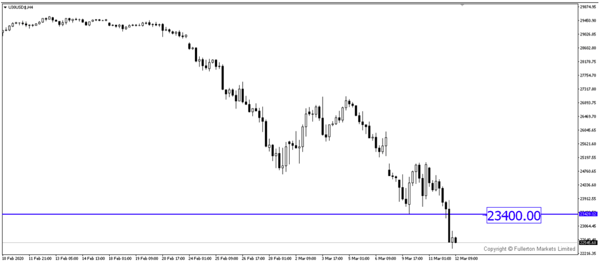

- The Dow Jones Industrial Average has lost 20.3% on an intra-day basis since 12 February 2020.

- A bear market begins when stocks fall by 20% from its peak or high. The last time US stocks were in bear territory was during the 2008 financial crisis.

- As the situation of COVID-19 continues to worsen globally and with no news of vaccine available, we believe that the impact on the global economy will be greater than expected.

- However, we have to remember that for the past few weeks, whenever Dow drops sharply, it is met with a sharp rebound as well. Therefore, taking a short on Dow requires a good entry price.

- Furthermore, the oil price war between Saudi and Russia still sees no agreement. An oil price war which saw oil prices fell by 30% is unlikely to spur any demand for goods and services that require oil as a raw material.

- Lastly, US President Trump has suspended all flights from Europe to the US for 30 days.

- Markets are looking at the US for support in terms of fiscal policy to stimulate the economy, but the White House has not announced any specific measures, which could be disappointing as they may be seen as being unprepared for the crisis or there may not be a fiscal stimulus at all.

- Dow is currently at the 22556 price level. We believe that price could rise higher towards 23400 as a form of technical rebound before falling lower.

Fullerton Markets Research Team

Your Committed Trading Partner