Fed Chairman Powell remained cautious on the economy but ruled out negative interest rates. Long USD/JPY?

- Federal Reserve Chairman Jay Powell gave a dire warning yesterday that the US economy could be stuck in a painful multiyear recession if the Congress does not dish out more stimulus packages.

- In comparison to Powell’s outlook, President Trump is optimistic that the economy will see a dramatic recovery at the end of this year and rebound with more momentum in 2021.

- Powell also raised concerns about long-term economic harm and warned that the outlook is uncertain with downside risks.

- The main focus of Powell’s speech was regarding the fed-funds rate pricing in negative interest rates in April 2021 last week. Powell addressed the matter and said that Fed has no intention to cut rates to negative for now.

- We believe that this should calm the markets as rates will not move into negative territory.

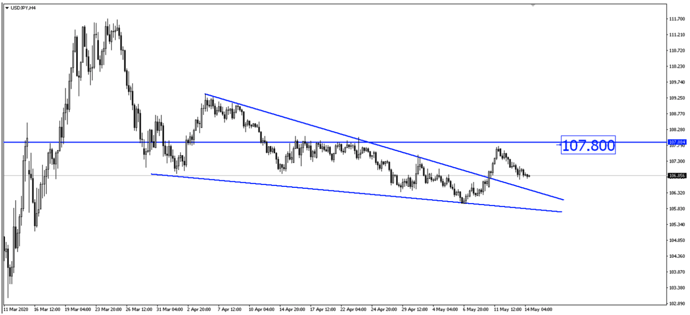

- USD/JPY could head higher as the dollar will continue to hold its safe-haven status with negative rates out of the way.

- USD/JPY could find support at the 106.60 price level and head higher towards 107.80.

Fullerton Markets Research Team

Your Committed Trading Partner