With growth and inflation forecast lowered and dot plot signalling two instead of three rate hikes, USD/JPY could fall further.

During the FOMC meeting last night, we saw the dollar rise after Fed Chairman Jerome Powell’s comments sounded optimistic ahead of market uncertainties. Even though Fed downgraded GDP and inflation forecasts, the dollar surprisingly rose higher because Fed was not as dovish as expected.

The market had braced itself for a worse outcome, such as a hike pause and a change in risk assessment. Though Fed did slightly tweak its forecast, it was not as bad as what the market expected. Market was pricing in only one rate hike on 2019 as shown from the Fed fund rates yesterday but Fed reduced it from three hikes to two. Powell further mentioned that the rate hikes in 2019 will depend on economic data and market conditions.

With that in mind, Fed could be the only central bank to tighten in the first half of 2019 which could provide support to the dollar in the longer term. Even though the dollar held steady during FOMC last night as Fed held on to their positive outlook, it remains that rates will only increase if data improves. Therefore, the dollar could continue to fall once the market digests the news.

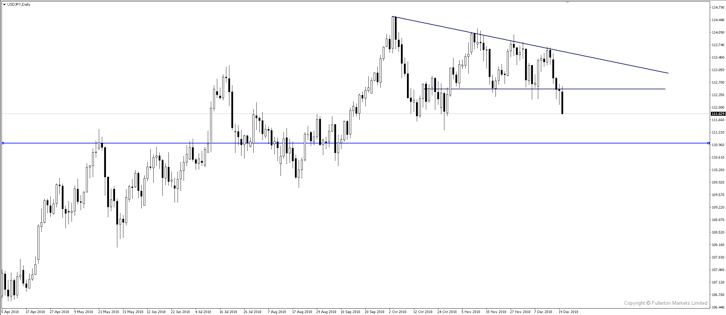

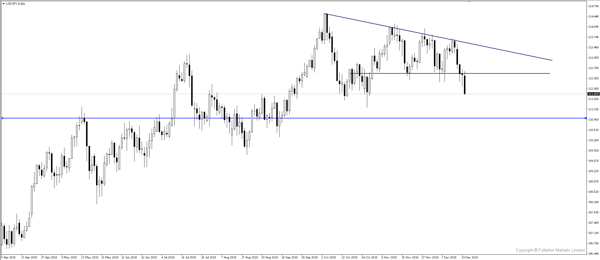

USD/JPY has broken its 112.50 neckline and could continue to head towards 111.00 price level in time to come.

Fullerton Markets Research Team

Your Committed Trading Partner