With Boris Johnson’s “do or die” commitment to leave the EU by the hard deadline of 31st October, a no-deal Brexit seems highly probable. Sterling could weaken across the board.

After a six-week leadership race, Boris Johnson defeated rival Jeremy Hunt to succeed Theresa May as the British Prime Minister after her deal for Brexit was rejected three times. Boris Johnson is now taking over a country not only in a crisis, but with a government that is split up as well.

Johnson has until 31 October to negotiate a new deal with the EU before the UK is to leave the bloc. He said in his acceptance speech that he is going to renegotiate with the EU. He has also previously mentioned that he is not afraid of a no-deal Brexit.

Sterling fell for three days straight since market open as Johnson’s victory revived Brexit anxiety and started a new civil war within the government over Brexit. A group of ministers including Justice Secretary David Gauke, International Development Secretary Rory Stewart and Finance Minister Philip Hammond have announced that they are going to quit as they cannot work with Johnson.

Johnson plans to secure better terms, with his main aim being to remove the backstop guarantee plan for the Irish border. However, the EU has flatly rejected those pledges before and there is no reason for them to change their decision. This could mean that the UK could head towards a no-deal Brexit by the end of October.

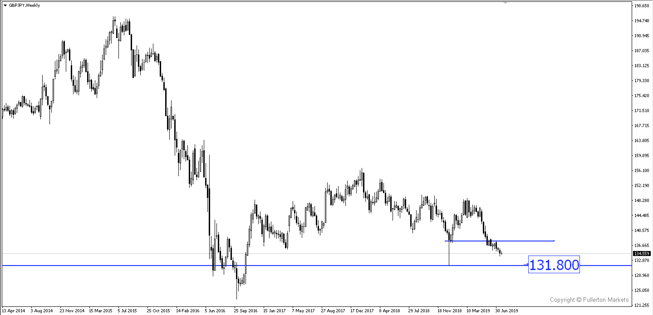

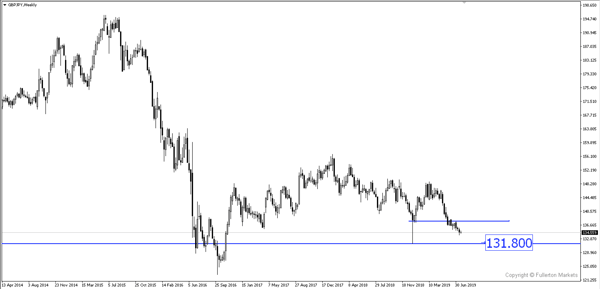

GBP/JPY could be hit the hardest as a no-deal Brexit could mean that the UK will crash out of the EU with inevitable economic damage and disruption to trade which will affect global growth. This could lead to the strengthening of safe havens. We see GBP/JPY hitting 131.80 by the end of the year if a no-deal Brexit happens.

Fullerton Markets Research Team

Your Committed Trading Partner