With both Fed and Bank of Canada cutting rates by 50bps, the rest of the major central banks may start to follow. Long XAU/USD?

- Federal Reserve Chairman, Jerome Powell, announced that they will be cutting rates by 50bps in the next Fed meeting to counter the global slowdown and impact from the coronavirus outbreak.

- Dollar fell almost immediately as expected due to the rate differential between Fed and the rest of the central banks.

- What perplexed the market was that the stock markets did not hold. A rate cut, in theory, should boost the stock markets due to cheaper loans, but the Dow initially rose in relief before falling to more than -800 points at the end of the NY session.

- On the other hand, Bank of Canada cut rates by 50bps as well last night, 25bps more than forecasted.

- The central bank said on Wednesday that it cut its target for the overnight rate because COVID-19, as the virus is known, was "a material negative shock" to Canada's already softening economic outlook.

- The cut in the bank's key rate is the first since the summer of 2015 and brings the rate to a level not seen since early 2018.

- Having said that, we believe that the rest of the major central banks will follow suit as the cut by Bank of Canada has shown.

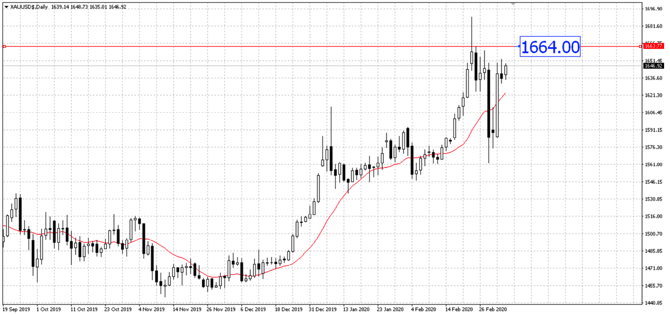

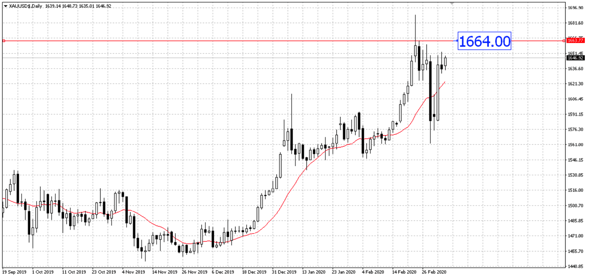

- It may be hard to pinpoint which currency will outperform which, but we can be sure that Gold (XAU/USD) will shine in times of low interest rate.

- We expect price to move higher towards 1664 this week.

Fullerton Markets Research Team

Your Committed Trading Partner