RBA does not expect inflation to pick up in the near term, possible to short AUD/USD?

RBA left their cash rate unchanged at 1.5% during its November meeting, saying inflation is likely to remain low for some time. This suggested the central bank is not ready to join the global tightening at this moment.

- CPI and Core inflation is below the RBA’s 2%-3% target range, that means RBA is not likely to offer the “hiking signal” to the market. A higher Aussie will hurt the nation’s inflation recovery.

- Appreciation in Aussie is expected to result in slower economic activities. This is not favoured by RBA based on the current macroeconomic condition.

- Australia added more than 200,000 full-time jobs this year and unemployment has fallen to 5.5%. However, RBA said that “a sizable degree of spare capacity” still remains in the labour market.

- Using US as an example, inflation rate remained soft despite its unemployment rate hitting 4.1% last month. This could be the same case in Australia.

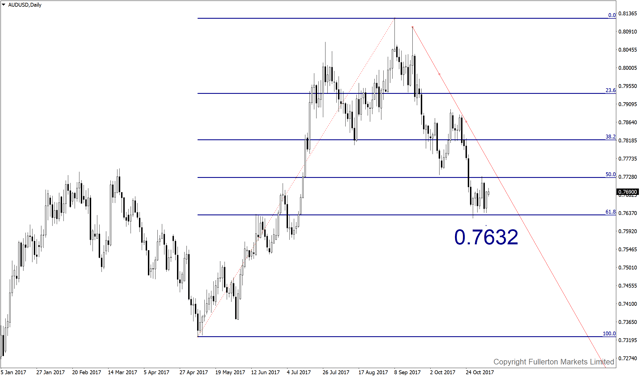

- AUD/USD had been in a downtrend for the past 2 months, partly due to the dollar strengthening. Without RBA signalling any intention to tighten the policy, we can expect the downtrend to continue.

- China PBOC’s governor Zhou had reiterated the authorities’ determination to prevent “Grey Rhino” risk still remains. This means the on going deleveraging in Chinese financial system will continue or even accelerate, which is considered as negative to Aussie dollar.

Fullerton Markets Research Team

Your Committed Trading Partner