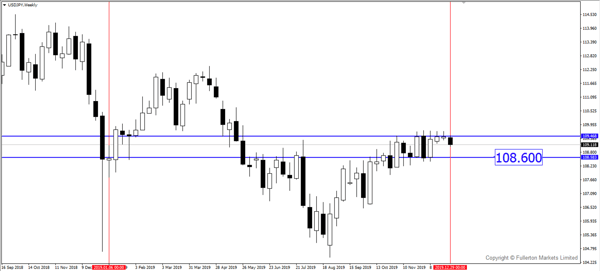

As trading ranges typically expand during the new year week, we expect USD/JPY to move lower from a technical perspective.

No major data to be released this week

The last trading week of 2019 is usually a quiet week as most traders are still on holiday. On the data side, we only have CB consumer confidence, Caixin Manufacturing PMI and ISM manufacturing PMI that are worth looking at. Liquidity will definitely be on the low side with no triggers from any Forex data.

Furthermore, the flash crash on 3 Jan 2019 where USD/JPY fell 500 pips in a matter of minutes will continue to put traders on hold, with most of traders waiting for 3 Jan to be over to be on the safe side.

USD/JPY broke a support line on the daily chart at the price level 109.10 despite stocks making a new historic high which is unusual as USD/JPY typically has a strong correlation with US stocks and risk appetite. Hence, it is either stocks gains are retracing, or USD/JPY is waiting to break out back to the upside. We feel that it could be the former.

Our Picks

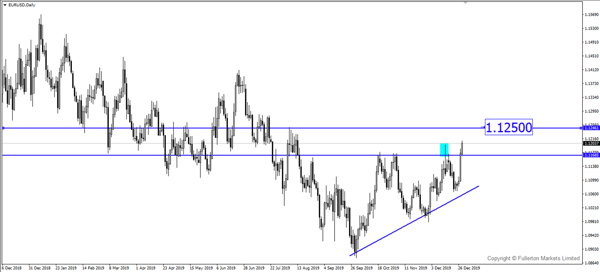

EUR/USD – Bullish.

This pair may continue to rise towards the 1.1250 price level after breaking a strong resistance.

USD/JPY – Slightly bearish

This pair may fall towards 108.60 as stocks may start to retrace.

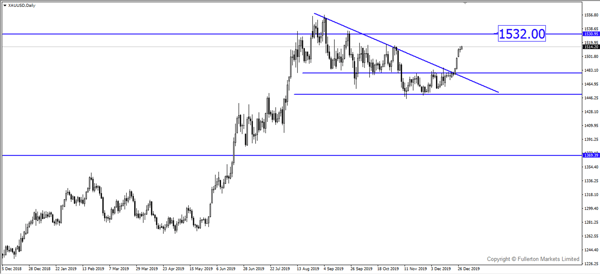

XAU/USD (Gold) – Slightly bullish.

We expect price to rise towards 1532 in the coming weeks due to risk aversion.

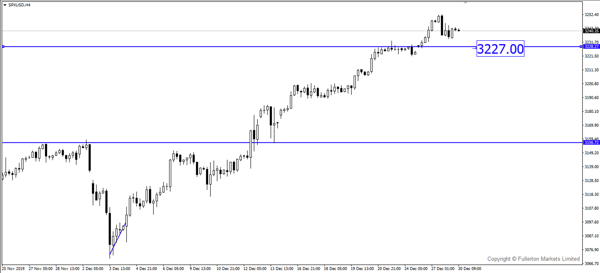

SPXUSD (S&P 500) – Slightly bearish.

Index may fall towards 3227 this week from profit taking

Fullerton Markets Research Team

Your Committed Trading Partner