With more MPC members expected to vote for a rate cut tonight due to weaker UK’s growth in general, we could expect dovish sentiments from Governor Carney. GBP/JPY could slide further.

- This will be Bank of England’s (BoE) Governor Mark Carney last monetary policy meeting before he hands over the reins to Andrew Bailey

- UK economic data has been weakening since its last meeting as consumer spending fell despite holiday discounting, inflationary pressures eased, and wage growth stagnated

- Last week, we saw UK PMI data surprising to the upside which pulled down the odds of a rate cut from 70% to 54%

- In its last meeting, Two policymakers, Michael Saunders and Jonathan Haskel, voted to cut rates in both of the last two MPC (Monetary Policy Committee) meetings in November and December

- With the Coronavirus outbreak, growth forecast could be cut by BoE and they might even go with an immediate rate cut this time round

- Though, we have to take into account of Brexit whereby the deadline to leave EU is set tomorrow 31st January 2020. Thus, we may see a whiplash in the market as leaving EU could be a relief which could boost sterling

- All in all, we firmly believe that tonight’s BoE monetary policy decision will be dovish either way and we should only stick to shorting sterling pairs with caution on Brexit updates

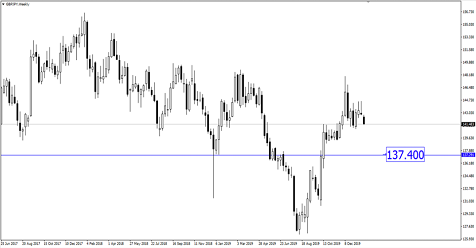

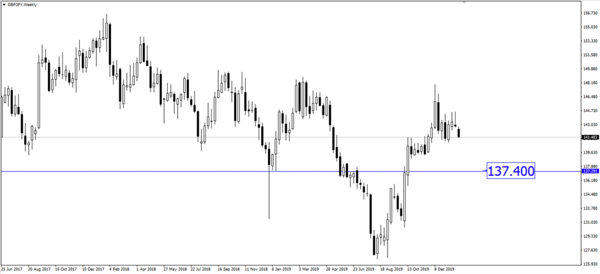

- GBP/JPY could be a good pair to short as risk-off sentiments will only continue to increase with the Coronavirus spreading at unprecedented speed. We expect price to fall towards 137.40

Fullerton Markets Research Team

Your Committed Trading Partner