The slight pullback of US 10-Y Treasury yield to 2.866% may have weighed on the dollar. Short USDJPY?

Japan’s CPI last Friday came in at 1.4% y/y versus 1.3% y/y expected. Excluding fresh food, prices rose 0.9% y/y versus 0.8% expected. Lastly, removing food and energy, inflation was 0.4% versus 0.3% expected. This was the highest headline rate since 2015. However, the gained in yen fizzle to the price level just before the announcement.

There could be a few explanations for it. Firstly, Japan’s inflation was still growing slowly and far from its target of 2%. BOJ is also expected to continue their ultra-loosening monetary policy by keeping its long-term bond yield at zero percent for now. Secondly, the volatility in the market seemed to be easing and FX traders are looking at how the stock market is behaving. The Nikkei share average fell to one-week low at the start of last week and lead to yen appreciation. Taking this into account, yen will move inversely with the Japan stock market.

The default understanding how of various currency pairs move tend to be influenced by a single economic indicator. Since early 2013, BOJ started massive qualitative and quantitative easing programme. That economic indicator was the differential in monetary base between the two relevant countries. The changes in US fiscal policy may have changed the indicator from monetary base differential to current account imbalances which might explain the shift from strong to weak dollar. This unexpectedly strengthened the yen as a side effect.

Even popular carry trades are plunging as the surge in Yen erodes gains as reported by Bloomberg. As the US 10-Y treasury yields fall, there is a massive flow of funds into safe havens, sending yen higher. Despite the volatility in the equity-market softening, funds continue to flow into traditional safe havens and this highlights the sensitivity to market fluctuations by traders. Furthermore, yen’s surge could be due to central banks around the world starting to slowly reduce their exposure to the dollar by selling US Treasury debt.

The US dollar on the other hand ran out of steam after rallying from a three-year low last Thursday. The market sentiments that leaned towards an overdone in dollar's sell-off plus the somewhat hawkish tone in January's FOMC might has gave the dollar the temporary boost we saw last week. The dollar index gained nearly 2% since hitting a three-year low of 88.253 on Friday. Moreover, the easing of US 10Y treasure yields might have also hurt the dollar.

The main driver for dollar will be Fed Chair Jerome Powell’s March meeting where he is expected to deliver his first Fed hike. We expect him to maintain continuity and limit market volatility as he will try to be cautious to prevent any stock crash, yield spikes and dollar soaring. However, many investors will be eager to see if Powell’s views have changed since Yellen’s era given that market dynamics have shifted significantly.

Our Picks

USD/JPY –Bearish.

The fall in US 10-Y Treasury yields and the rush into safe havens like yen could cause this pair to fall further.

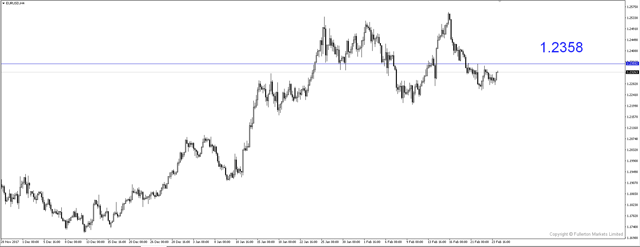

EUR/USD – Slightly bullish.

With the weakening of dollar, we should expect this pair to continue upwards given the 1.2280 price level has been rejected multiple times.

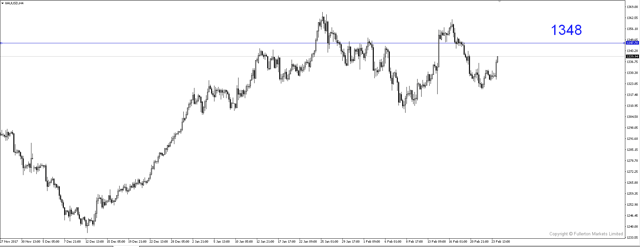

XAU/USD (Gold) – Bullish

Last week trade call on gold was spot on as we gained closed to 250 pips on gold.

Gold as a traditional safe haven has risen due to risk aversion leading to the inflow of funds. We expect gold to meet some resistance at 1348 price level.

Fullerton Markets Research Team

Your Committed Trading Partner