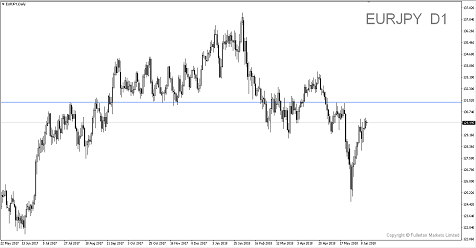

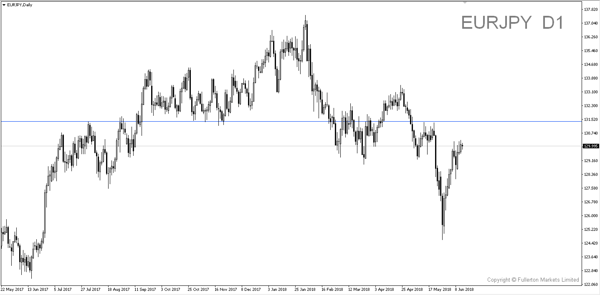

If ECB were to ditch its crisis-era stimulus and start the clock on interest-rate hikes, Long EURJPY?

ECB’s are meeting tonight to discuss plans on winding down its €2.9 trillion bond-buying programme. The decision to end the controversial quantitative easing (QE) has been strongly hinted by ECB officials, most notably Chief Economist Peter Praet. Though it has been delayed due to a slowdown in eurozone economy and multiplying threats to growth.

ECB are ready to end its QE as the eurozone economy is slowly climbing back and inflation has been rising. Their inflation has hit the European Central Bank’s target for the first time in a year during May 2018.

There are a few key points questions investors want to know:

- A concrete end-date for QE. ECB has been shying away from announcing any specific plans in ending their bond-buying programme even though they have gradually reduce it to €30 billion a month from €80 billion a month.

- President Draghi Economic Projections. As the economic outlook is currently cloudy with growth in eurozone still slower as compared to closing months in 2017. Weak data for industrial production and tensions over trade could weigh on the economy for the next few months.

- ECB’s standpoint over Italy political crisis. The arrival of a new populist government has amplified long-standing concerns about Italy’s public finances and commitment to economic reforms. Draghi, a former governor of the Italian central bank may be expected to give his opinions of the new government and ECB’s stance in protecting member states.

Fullerton Markets Research Team

Your Committed Trading Partner