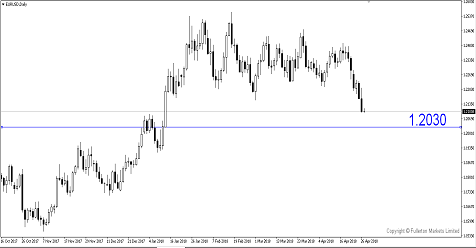

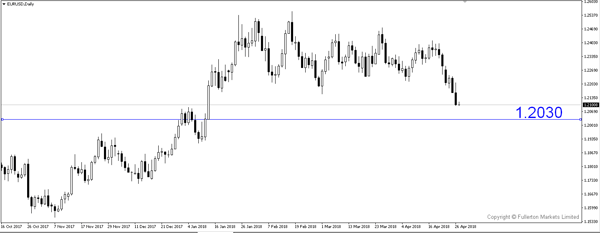

Euro at 3-month low after ECB meeting, will it break the 1.21 level?

Signs of a slowdown in the eurozone economy are of concern by ECB now and we think that Draghi could be well prepared to delay plans for withdrawing stimulus if necessary. In our opinion, the pull back in EUR/USD is a reflection of ECB’s policy outlook and not a knee-jerk reaction.

- EUR/USD touched a 3-month low as eurozone government bonds rose after the latest ECB policy meeting offered few reasons to turn bullish on the region’s economy.

- Mario Draghi acknowledged that the pace of the eurozone recovery had moderated, though he gave no clues on how future monetary policy or guidance would be heading.

- ECB needs more information before it can engage in a meaningful debate on the next policy move.

- For the outlook of EUR/USD, we expect it to test 1.2030 in weeks as there is a lack of reasons to buy euro. However, the pace of the decline would largely depend on the UST 10-year yield.

Fullerton Markets Research Team

Your Committed Trading Partner