Risk sentiment improved after China cuts rate, long USD/JPY?

China cuts rate after growth continued to slow down

China lowered the cost it charges on short-term open-market operations for the first time since October 2015, a move aimed at shoring up confidence following a string of poor economic data. This is likely to trim the demands on those safe haven assets like the Japanese Yen.

PBOC cut the interest rate on its seven-day reverse repurchase agreements to 2.5% from 2.55% on Monday. The authorities also added 180 billion yuan of cash into the financial system via open market operations, helping to alleviate liquidity concerns. The yield on 10-year government debt fell 4 basis points to 3.2%, its lowest level in a month, while the Shanghai Composite Index reversed losses to gain 0.2%. The yuan was 0.1% weaker against the dollar.

The miniature adjustment to the rate that banks pay to borrow from the central bank signalled a continuation of the restrained stimulus policy that officials have adopted, even amid growing evidence that economic growth will dip below 6% next year. On Saturday, the PBOC’s quarterly report warned on growth risks but also on rising inflation, highlighting the limited room that monetary policy has to respond.

The cut broadens the scope of the PBOC’s easing and signalled an effort to reduce rates across the policy curve spanning overnight to one year. This suggest that rising consumer inflation isn’t a “material constraint” on the central bank, which means a higher probability that the Loan Prime Rate will be lowered later this week.

Monday’s move comes after the central bank unexpectedly injected $29 billion of medium-term cash on 15 November, and also cut the cost on the loans earlier this month. Economic data from credit expansion to industrial output trailed economists’ forecasts in October. The lower short-term rate reduction matches a similar adjustment to the cost of one-year funding made earlier this month.

Taken together, the rate reductions plus liquidity injections should mean banks report a lower overall cost of borrowing for the economy later this week when the loan prime rate is released.

The PBOC has refrained from aggressive easing amid accelerating inflation and concerns on a debt build-up. Top leaders have pledged to keep monetary policy prudent while striking an “appropriate” balance between tightening and loosening. The lack of stronger stimulus is taking a toll on bonds, sending the yield on 10-year sovereign notes to the highest level since May this year.

The weighted average interest rate of regular bank loans edged up to 5.96% in September, slightly higher than 5.94% in June, according to the PBOC report released over the weekend. This indicates that the interest rate revamps the central bank introduced in August have not successfully lowered overall borrowing costs.

Our Picks

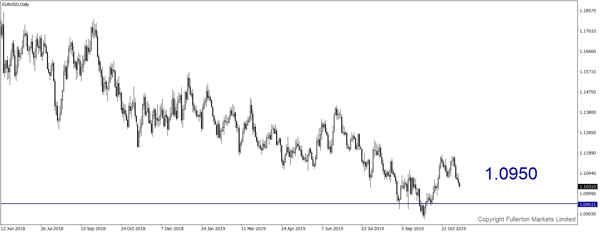

EUR/USD – Slightly bearish.

This pair may drop towards 1.0950

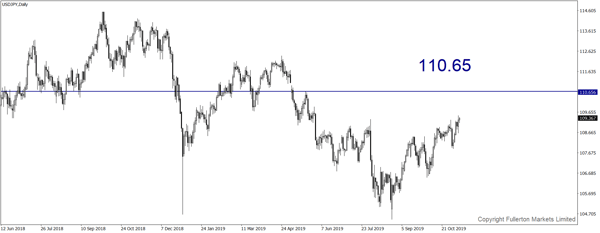

USD/JPY – Slightly bullish.

This pair may rise towards 110.65 amid improving risk sentiment.

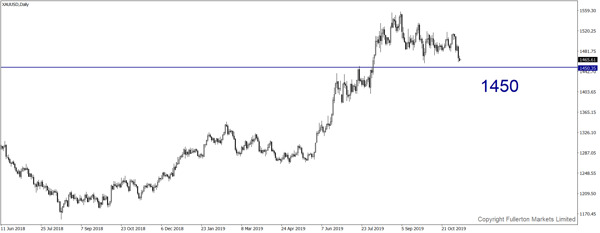

XAU/USD (Gold) – Slightly bearish.

We expect price to fall towards 1450 this week.

U30USD (Dow) – Slightly bullish.

Index may rise towards 27125 this week.

Fullerton Markets Research Team

Your Committed Trading Partner