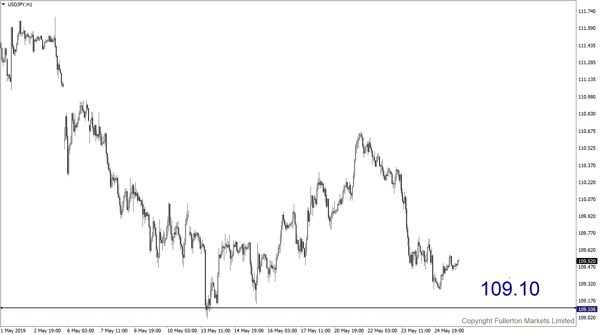

US stocks’ direction has been in tandem with USD/JPY for a long time. Short USD/JPY when stocks are too expensive now?

US stocks valuation is too high, signalling a possible retracement

The recent escalation in global risk is a game-changer which could put overvalued American stocks through months of pain – for at least the rest of the year.

A few months ago, an increase in bilateral tariffs was seen as 2019’s negative tail-risk. In hindsight, that looks optimistic and US stocks have yet to price in the slowdown in growth and earnings. There’s an assumption that it’s just part of negotiations and will soon be resolved. The evidence provides little support for such complacency.

The impact here is perhaps even more damaging for a US equity bull market that has been so dependent on the tech sector. Many US-based investors seem to be slow in registering where the world’s consumer power now lies. Asia has more than 50% of the world’s population, with almost 20% in China alone. This is a tech-savvy, consumption-focused, middle-class population with a rising disposable income.

After a bullish run in US equities for 2019, market turned bearish on 30 April. Analysts highlighted stretched valuations but expected only a multi-week correction before fresh highs later in the year. The landscape has changed enormously and those valuations now look far more out of whack. Citi US economic surprise index has been below zero for almost five months, during a time when most were optimistic of the outcome of the trade negotiations. In the coming months, we could expect the outlook to deteriorate further.

The S&P 500’s blended 12-month forward-looking price-earnings ratio stands at 16.3 versus the 10-year average of 15. Worryingly, that is before the analysts’ slashing estimates further, meaning to say it could fall further to hit that long-term average. The price-to-book ratio is 3.3, versus the 10-year average of 2.6. The price-to-free-cash-flow ratio is 22 versus the 10-year average of 16.5. And these frighteningly expensive valuations are for just the S&P 500, let alone some of the more tenuously priced unicorns and tech stocks.

It’s not that the world economy is set to collapse. It’s not even that positioning is overly stretched or liquidity conditions are particularly tight. It’s just that the value proposition in US equities has suddenly vanished and will only look more negative by the week.

When you add in the fact that the credit cycle is turning, it gets a little scarier. Furthermore, considering that any move by the Fed to support financial assets has been significantly diminished with rate cuts already well-priced into markets. At best, Fed can only deliver the monetary easing that’s priced, but that’s no guarantee still. And how will investors react to the signal of a rate-cutting cycle? The last time they experienced one was in 2008, so it may spark some worrying flashbacks.

Our Picks

USD/JPY: The pair may drop towards 109.10 this week.

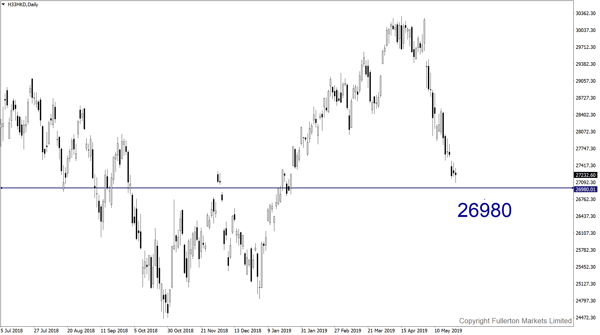

HSI/USD (Hang Seng Index): Index may drop to 26980 this week.

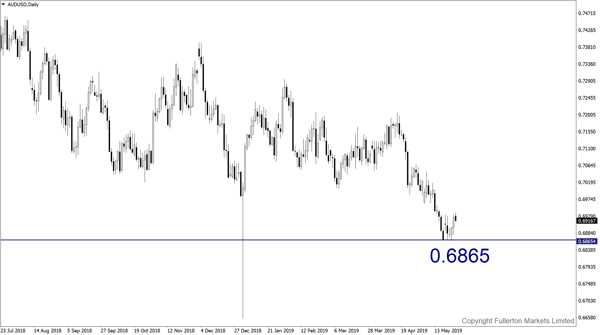

AUD/USD: This pair may drop towards 0.6865 this week.

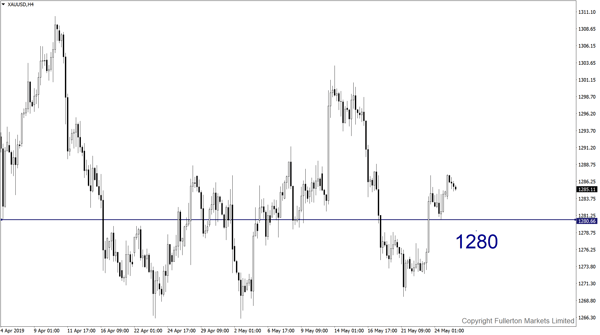

XAU/USD (Gold): This pair may drop towards 1280 this week.

Fullerton Markets Research Team

Your Committed Trading Partner