After last week strong US data and with improving risk sentiment, long USD/JPY?

US jobs data is likely to offer support to the dollar

US jobs report is strong across the board, living up to expectations set by President Trump’s pre-release tweet and also hardening the case for a Fed rate increase this month. Nonfarm payrolls rose to 223k in May versus estimate of 190k while the unemployment rate fell to 3.8% versus the prior of 3.9%. Average hourly earnings picked up to 0.3% m/m from 0.1% prior month, well above the estimated pace of 0.2%.

May jobs data should support the dollar, thanks to both a stronger-than-expected non-farm payroll growth and the rise in average hourly earnings Jobs report showed that the labour market is humming along despite higher rates and trade war fears. This should increase Fed pricing for hikes between now and end of next year.

Chinese shares inclusion in MSCI are important

MSCI is the world’s biggest index compiler, with roughly $12 trillion in assets benchmarked to its products. Some exchange-traded funds, international retirement plans, and endowments that track an MSCI index will have to, for the first time, buy many of the A shares that are being added. After China capital outflows accelerated in past years, a meaningful inclusion would help to send billions of dollars flowing into the A Share market. MSCI itself said that the initial inclusion is expected to channel around $17 billion in passive funds which could rise to $35 billion in coming years. These inflows are less than A shares’ trading volume in one day, however, it may overhaul the Chinese capital market gradually and improve the investment atmosphere over a period of time. However, lifting the index inclusion factor from 5% to full inclusion would raise China A-share weightings 20 fold which accounts for 15% of MSCI's Emerging Markets Index from the initial 0.73%. Nonetheless, it could take 5-10 years for it to happen.

The reality is that many foreign institutional investors are still not very familiar with the mainland’s stocks market, many of them would take a “wait-and-see” approach for now. Though, some unique characters of the mainland stocks market would attract certain types of investors.

First, to those managers who looking for diversification, Chinese stocks offer a great opportunity. S&P 500 correlation with the Shanghai composite index only stands at 0.4 for past 10 years while its correlation with Hong Kong stocks reached almost 0.8 in this period. There are also lots of unique sectors in China that foreign investors may find it hard to access in other markets, such as white liquor and traditional Chinese medicines. Take KWEICHOW MOUTAI as an example, its share price rallied 130% since the end of 2016.

Second, A shares market provides investors who are looking for alpha opportunities. Retail investors account for as much as 85%-90% in the domestic stocks market, much higher than most of the major indices in the world. With the lack of deep financial and economic knowledge, many investors in this category pick the stocks through rumours, news-flow, and gut-feeling. As opposed to looking more into companies and economic growth’s fundamentals. As such, great mispricing means there are ample of opportunities for foreign investors to profit as they aim to outperform the benchmark index.

China still has work to do before MSCI increases the weighting of its shares. In April, China quadrupled the daily quota on cross-border trading channels between Hong Kong and mainland exchanges, which are also known as China’s so-called stock connect programs. MSCI welcomed the move. The expanded quota paves the way for MSCI to raise their A shares’ weighting in the future starting from 5 percent. However, some restrictions remain such as the 10 percent daily limit in stock moves that quash trading volatility, as well as a cap on foreign ownership.

Besides that, any huge amount of stocks purchases by foreign institutional investors may require an FX hedge. At this moment, there is no perfect onshore yuan hedging tool available yet. Thus, it is important to align the onshore CNY and offshore CNY at close levels for most of the time to mitigate the FX risk for those who purchase the assets denominated in yuan.

Our Picks

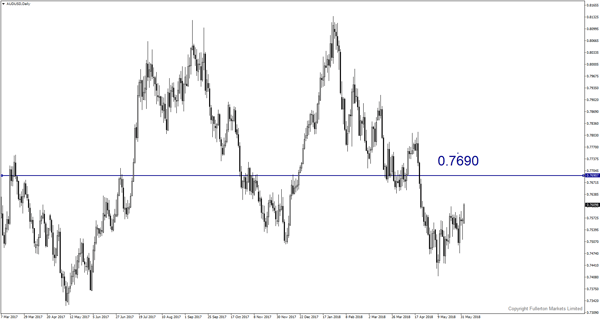

AUD/USD – Slightly bullish.

China to include AA rating bonds into its MLF’s collateral pool may increase domestic activities. This may push AUD/USD towards 0.7690.

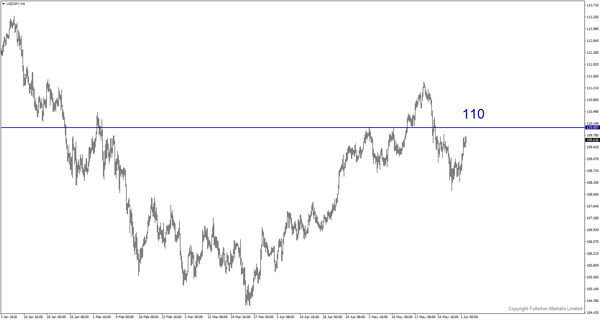

USD/JPY – Slightly bullish.

We expect this pair to rise towards 110 amid improving risk sentiment and solid US data.

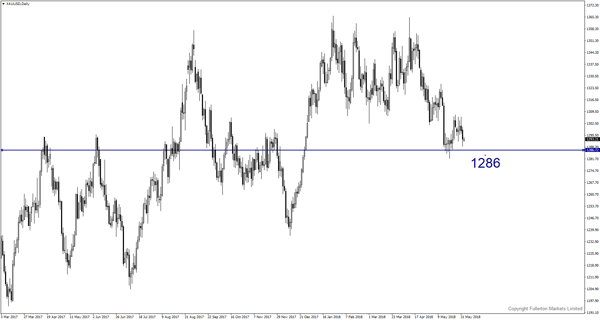

XAU/USD (Gold) – Slightly bearish.

We expect price to drop towards 1286 this week.

Fullerton Markets Research Team

Your Committed Trading Partner