Fed seems not willing to rescue US stocks, continue to sell USD/JPY?

The wage growth should not have come as a surprise in the first place given the economic expansion. It just showed how vulnerable stock markets were and how low the boiling point could be. Even so, not everything is bad news. Global financial markets should feel blessed that Janet Yellen had left the Fed earlier, not later.

Fed has used their emergency monetary tools for far too long and are currently caught between a rock and a hard place because the financial system they created is so powerful in driving up asset prices to the extent that they now cannot normalise the rates in a normal way. Various models suggested Fed fund rates should be 3% at least, instead of the current 1.25%-1.5%. In the past, what drove the financial markets was the economy. But given the past two recessions which happened in 2001 and 2008, were driven mainly by the financial markets, policy makers are discreetly worried that the current situation may trigger a third one.

Explicit forward guidance and an extreme sensitivity to downside risks might have helped the economy. However, it bred an unprecedented level of complacency in the financial markets. To be sure, this was led by Yellen to some extent which was followed by ECB and BOE later on. (Excuse us if we made a wrong claim here). Nevertheless, the fact is the measure of four-year cross asset volatility was consistently low during Yellen’s era and was populated entirely by her entire tenure.

The market was initially encouraged by hawkish comments from Fed, ECB and BOE policy makers because they suggested that central banks were confident about the global economy. However, if the selloff continues, will that change their rhetoric? Is their confidence misplaced? No one knows for sure how markets will respond to stimulus being curtailed or withdrawn by the major central banks. If this is the concern now, why do these central bankers took so long to shrink their mega-sized balance sheet? What were they afraid of? The answer is volatilities. However, things could be changing soon, and welcome to the new-era.

The Greenspan put is finished, we should not expect the new Fed Chair Jerome Powell to step in and try to end this stock rout. US central bank officials William Dudley, Esther George and John Williams recently reinforced the idea that the Fed is on course to hike three times this year. Dudley called the stock selloff “small potatoes”, while Williams even spoke about the possibility of four hikes. Speculative policy makers may hold off in March is premature. The Fed won't be playing the role of saviour or at least in the coming weeks.

Stay alert for rising Treasury yields, a key cause for the turmoil rocking markets. The fact that bonds have not rallied during the global stock rout was a huge warning sign. The last time the S&P 500 fell more than 10% in early 2016, it sent 10-year yields plunging 35bps in January alone. There's no hint of any such rally this time round.

It’s difficult to blame the current volatility on Jerome Powell when he has not spoken a word yet as Chairman of the FOMC. But perhaps that’s one of the issues: markets knew the strike price of the so-called "Yellen put" but have no clue about Powell’s. At the same time, global recovery, domestic inflation pressures, and a sharp increase in net issuance suggested that the macro backdrop is going to be a lot more challenging for the new Fed chief than it was for his predecessor. In such a scenario, we see US stocks having further room to fall in coming months.

Our Picks

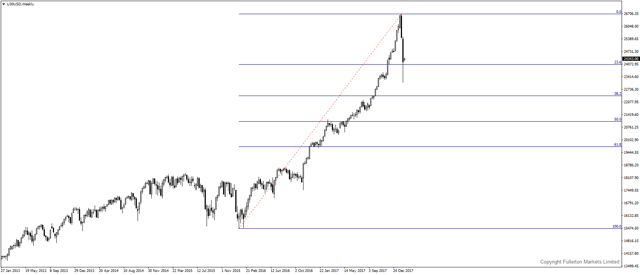

U30USD (Dow Jones) – Slightly bearish.

Gains last Friday could be due to technical instead of fears easing. Price may test 24030 in next 10 days.

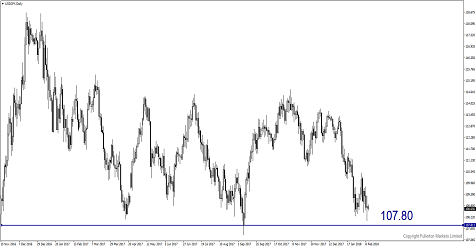

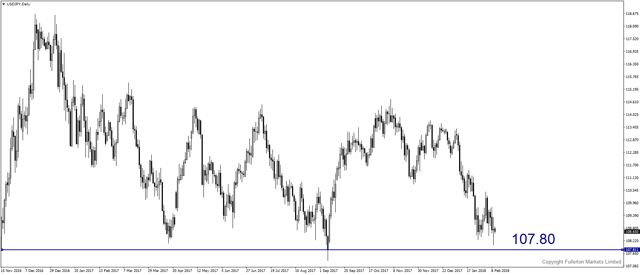

USD/JPY – Slightly bearish.

Volatilities remain high versus levels in recent years, USD/JPY could fall towards 107.8 this week.

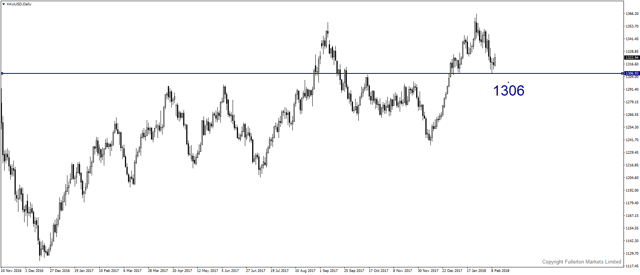

XAU/USD (Gold) – Slightly bearish.

We expect price to fall towards 1306 this week as dollar index stabilises above 90 for now.

Fullerton Markets Research Team

Your Committed Trading Partner