Trump and Xi will be having their formal meeting next month and Chinese sources are suggesting a breakthrough could occur. The improvement in risk sentiment could push gold lower in the short term.

China’s biggest problem isn’t tariffs anymore

Optimism for a resolution to the trade war seemed to come from China as the Trump administration did nothing to show willingness to come up with a deal. The new round of tariffs is not the main issue for China as the tit-for-tat tariff war has been going on for more than a year. It’s not the economic reports which are too mixed to prove any actual slowdown.

The reason why China could be feeling the heat is due to a decoupling push by the US to reduce their reliance on China for their manufacturing needs. Google shifted its Pixel smartphone production from China to Vietnam and some of its home speakers to Thailand. Google is not the first US-based company to announce the shift either. More than 50 other big names have moved out of China or scaled back operations.

Decoupling is not an economic stimulus for the US

Even as the decoupling continues to trend, it should not be seen as a stimulus to the economy. The tariffs on Chinese goods are not making US citizens richer. The real benefit is that it acts as a national security benefit. The US is still the largest consumer market in the world, and they are looking to shop out of China due to the added tariffs. With less reliance on Chinese goods and decoupling of US companies’ operations, China is forced to either slow this trend or end the trade war.

We do not expect safe havens such as gold and yen to weaken instantly as Trump’s sporadic moves, as seen from the past few months, could occur again.

ECB to ease this week, followed by Fed next week

ECB and Fed will be the market mover for the next 10 days as their policy-making committees discuss recent economic developments, update their assessment of prospects and adopt whatever actions and guidance they deem necessary.

ECB is 100% priced in to cut rates by 10bps this week but may not unleash a fresh round of asset purchases. This was due to the recent pushback against restarting Quantitative Easing (QE) from some ECB officials. The rate cut will likely be accompanied by a multi-tier deposit rate, which exempts banks from some of the ECB’s punitive charges for holding overnight deposits.

Our Picks

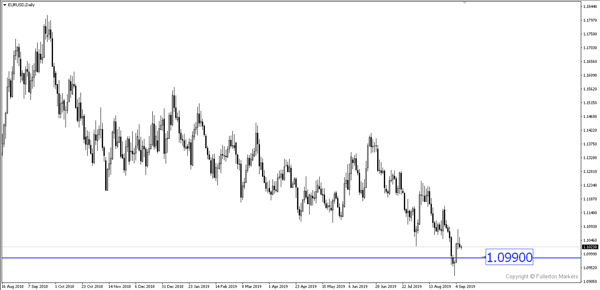

EUR/USD – Slightly bearish.

This pair can fall towards 1.0990 if the ECB were to open door for future cuts during its meeting this week.

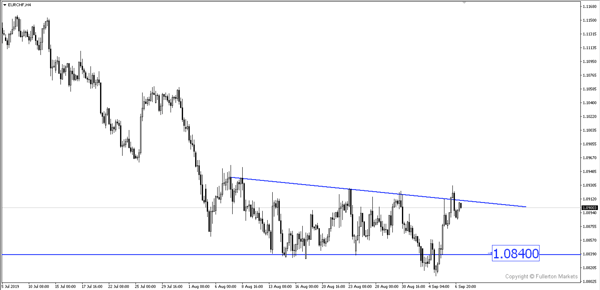

EUR/CHF – Slightly bearish.

This pair may drop towards 1.0840.

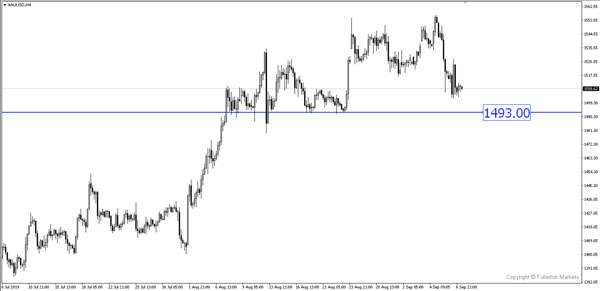

XAU/USD (Gold) – Slightly bearish.

We expect price to fall towards 1493 as risk sentiment starts to improve.

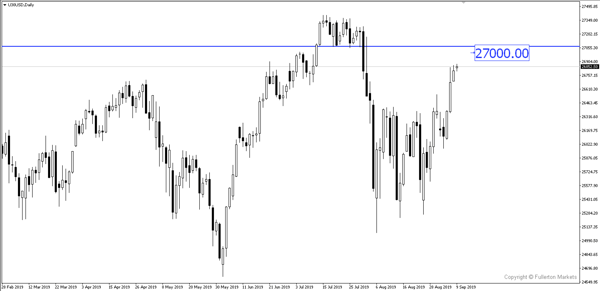

US30USD (Dow Jones) – Slightly bullish.

Index may rise towards 27000 this week.

Fullerton Markets Research Team

Your Committed Trading Partner