Trump plans to impose 10% tariffs on $200 billion in Chinese imports, Short AUDUSD?

Dollar gains as rising trade tensions fuelled safe haven demand and acted as a drag on other currencies.

China’s decision to impose 25% tariffs on US$34 billions of US goods in response to a similar US levy. Trade negotiations failed, and the trade war started when the two countries imposed 25 per cent of each other’s products worth of US$34 billion. The second batch of US$16 billion worth of sanctions is expected to take effect next week.

Dollar is rising by default as euro dollar continues to get pressured by Trump, sterling is pressured by Brexit and commodity dollars like New Zealand dollar and Aussie dollar are pressured by trade war fears. Trump has managed to alienate every single US ally during his tour in Europe which seemed to have driven investors into the dollar, as markets fear that his isolationist policies will damage global trade with export-dependent.

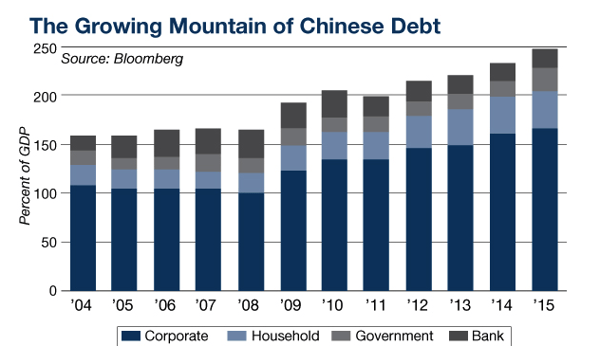

The trade war is masking an even bigger problem as China is facing a slowdown in its economy as well as the big run-up in debt that is in the financial system.

China’s total debt is now at 250% of its GDP, which is dangerously high.

If it is a problem for China's economy, it is a problem for the global economy in general and Australia's economy in particular. China's domestic policy to slowdown growth, flows through global growth and particularly to its suppliers, such as Australia.

China’s growth in total social financing and money supply hit historic lows last month. Even though China’s trade surplus with US swelled to a record in June, hitting a record monthly high of $28.97 billion, up from $24.58 billion in May, there were signs exporters were rushing shipments before tariffs went into effect in the first week of July which suggests the spike in the surplus was a one-off. It also pointed towards a declining domestic demand with a sharper than expected contraction in imports.

China’s GDP also slowed from 6.8% in 1st quarter to 6.7% in the 2nd quarter. The China’s economy is losing steam as its growth was at its slowest pace since 2016, noting slower industrial growth and caution from export manufacturers due to the trade war.

This week we have a string of economic data from China which will likely prove influential on the Aussie dollar. Australia will also be releasing its jobs data as well as monetary policy meeting minutes. Australia’s unemployment rate is expected to remain unchanged while the monetary policy meeting minutes should continue to reflect RBA’s Governor Lowe dovish stance on a weaker Aussie dollar.

Our Picks

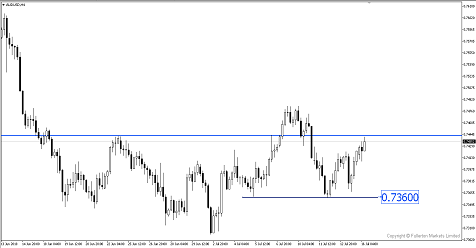

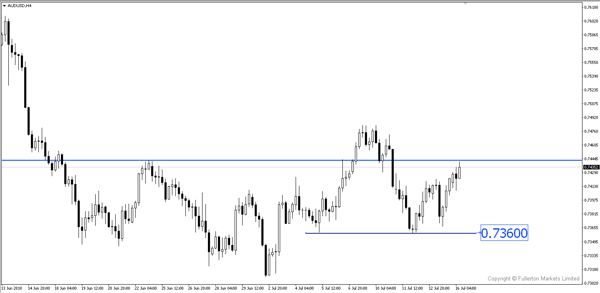

AUD/USD – Slightly bearish

Price is currently hitting a major resistance and with softer China GDP, we could see a fall to 0.7360 this week.

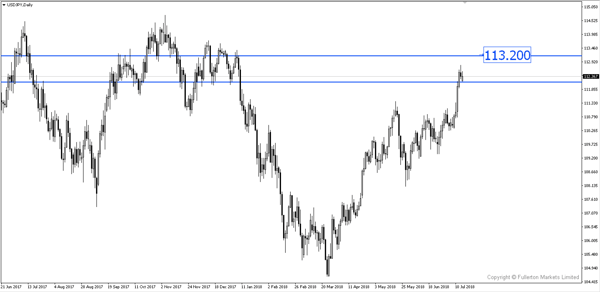

USD/JPY – Slightly bullish.

Dollar has become the main destination for safe-haven investors. We could see this pair continue to rise to 113.20 levels.

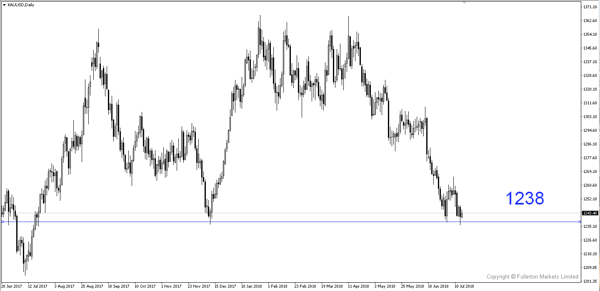

XAU/USD (Gold) – Slightly bearish.

We could see gold continue to fall to 1238 price level due to the weaker demand for Gold as a safe haven.

Fullerton Markets Research Team

Your Committed Trading Partner