If the rising trade tension is hurting global growth, short AUD/USD?

US trade restrictions, including threatened tariffs on cars and auto parts, would put "the global free trade system at great risk"

Data over the weekend shows that China export orders tumbled, dropping from expansion into contraction, which is a clear sign that trade-war concerns are starting to weigh on market sentiments. Traders should add more positions on safe haven assets like yen and gold until China-US trade deals clears up.

Trump’s assault on trade with China is moving from tweeted threats and abortive talks to the real-world. PMI readings for June released on Saturday showed a gauge of export orders tumbling into contraction, the clearest sign yet that the oncoming trade war is having a real, negative impact on growth. The sub-index of new export orders fell to 49.8 from 51.2, signalling that there is a weakening demand from other countries.

On Friday, the world’s two largest economies are set to begin charging higher tariffs on each other’s goods, marking a major escalation of the conflict. US is scheduled to impose tariffs on $34 billion worth of Chinese goods. China has said that it will slap tariffs on an equal value on US exports including agricultural and auto exports. The threat of higher duties can have an impact on orders in advance. In previous months, companies expedited exports because they had foreseen this complicated situation of international trade. As the trade friction between United States and China escalates, exports may start to ebb.

The decline of exports was also seen in South Korea’s June exports, which unexpectedly fell. Korea is a key supplier of computer chips and other components to China, which takes about a quarter of its exports. The Korean data comes out earlier than most other countries so it’s seen as an early bellwether for the health of global trade.

The arrival of a bear market in the China leading stock exchange and the fastest slump in yuan since 2015’s devaluation has already made it clear that investors are on the edge. Currently, it comes the question on how PBOC will follow through on last week’s signal that they’ll be more supportive of growth. Furthermore, whether the current structural approach where targeted policy tweaks aim at specific sectors like small business will be enough.

Our Picks

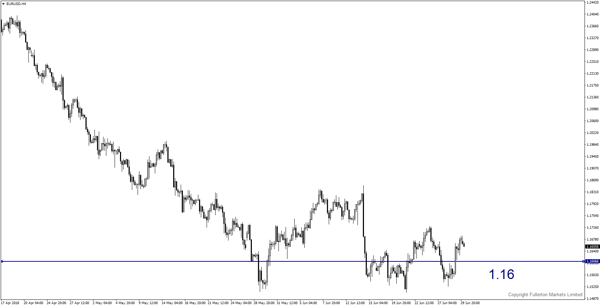

EUR/USD – Slightly bearish.

Leveraged funds have increased net EUR short positions to the highest since April 2017, according to CFTC data last week. This pair may test 1.16 this week.

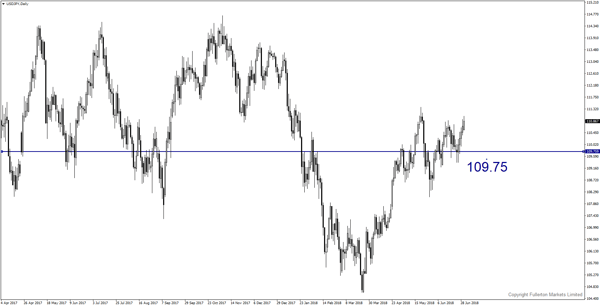

USD/JPY – Slightly bearish.

US trade restrictions, including threatened tariffs on cars and auto parts, would put the global free trade system at great risk, this pair may fall towards 109.75.

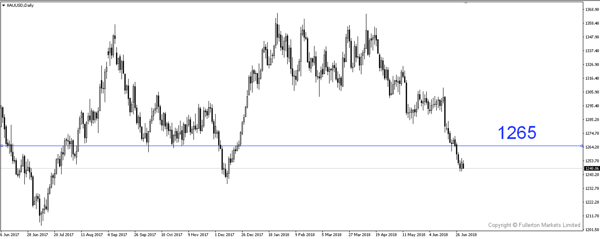

XAU/USD (Gold) – Slightly bullish.

We expect price to rise towards 1265 this week.

Fullerton Markets Research Team

Your Committed Trading Partner