UK Manufacturing enjoyed seven straight months of expansion which is one of the best since 2008.

With output and export expected to grow on the back of continuing support from a burgeoning global economy, long GBP/USD?

News of a “Soft Brexit” rekindled as Dutch and Spanish Finance Minster were said to be working together for a deal for Britain

The Sterling rallied as hopes of a “Soft Brexit” was mentioned by both the Dutch and Spanish Finance Minister. The market seemed to be hyper sensitive on news of Brexit once again after a period of fatigue since last year December saw Brexit rumours having less than intended impact. Though, we are cautious to the rally as Sterling still requires substantial progress in Brexit talks and strong UK Data to maintain the currency run.

This also leave the Sterling open to risk in any case Germany were to be against a “Soft Brexit”. However, it must be noted that Germany has been hinted since last year that it will be willing to grant UK Brexit concessions amid fears if Theresa May is ousted as Prime Minister as a result of Brussels playing hard ball. Hence, there is little worry of Germany pour cold water on the hope of a “Soft Brexit” deal.

As much as a “Soft Brexit” conveys a soothing message, it drives, instead, to a deliberate and cynical failure to implement the 2017 referendum result. The outcome of a “Soft Brexit” would leave Britain to be in a precarious spot. This results in UK still being in a single market but bound by huge restrictions on our economic and political freedom, but no longer able to vote on or influence those rules, even if they were changed to Britain’s disadvantage. Furthermore, a single market membership would mean annual payments to Brussels which amounts to billions of dollars. This would defeat the purpose of a Brexit in the first place.

A “Soft Brexit” would have Britain to breach EU rules by seeking single market membership along with special treatments from freedom of movement that no other country has. This is a direct conflict with EU’s core principles and if Britain were to be given the advantage, it would cause serious economic and political damage which can tear the bloc apart.

As much the ideology of “Hard Brexit” may sound extreme and damaging, it would definitely benefit Britain in the long run. There are 3 ways it can benefit Britain:

- Britain can avoid unnecessary and expensive EU rules during trades, including firms that do not trade with EU. Even as Britain is not a member in the single market of EU, they can still trade with EU under the World Trade Organisations rules, paying relatively low tariffs – as does other countries such as US, China and Japan and other major non-EU countries.

- Britain once out of the EU Union, is allowed to trade with other major economies (US, China, Japan and India) that EU has failed to cut a deal with. This brings great opportunities for Britain to modify existing agreement to their advantage with little to no restrictions. The current deals by the EU with the other major economies also favoured French agricultural and German manufacturing exports, rather than UK services.

- EU’s Customs are often wrongly presented as Economic Nirvana. Britain’s consumers are more burdened with tariffs deriving from the payment of membership to the EU’s single market. The freedom of movement within EU states leads to exploitation of cheap labour, causing the wages of UK’s workers and labourers. Thus, leaving EU would bring better opportunities for the workers.

Nonetheless, UK is having a strong hand to play in these Article 50 negotiations. UK being a major imports of EU have powerful business a lot to lose if UK were to imposed tariffs on these exports. The huge reliance on UK for businesses and trades gives UK an edge during discussion. No deal in this case is better than having a bad deal for UK as they having less to lose if they were to drag the deal as WTO’s rules allow them to trade on lower tariffs. This is compared to a bad deal that will cause UK to suffer and defeats the purposes of a Brexit.

Our Picks

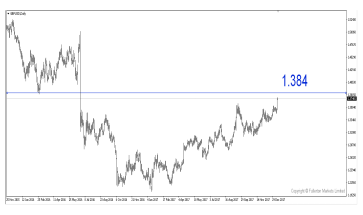

GBP/USD – Slightly Bullish.

Strong GBP Manufacturing results should propel this pair to 1.384

USD/CAD – Slightly bullish.

This pair may fall to 1.21 if Canada were to rate hikes on Wednesday during its Monetary Policy Report.

XAU/USD (Gold) – Slightly Bullish.

We expect price to continue to rally to 1354

Top News This Week (GMT+8 time zone)

Canada: Rate Statement, Wednesday 17th January, 11.00pm.

We expect figures to come in at 1.25% (previous figure was 1%).

UK: CPI m/m. Friday 19th January, 5.30pm.

We expect figures to come in at 0.5% (previous figure was 1.1%).

Fullerton Markets Research Team

Your Committed Trading Partner