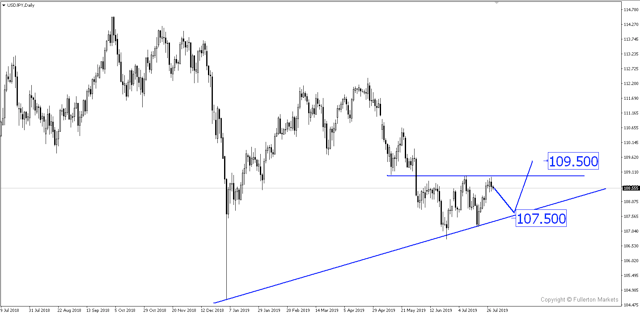

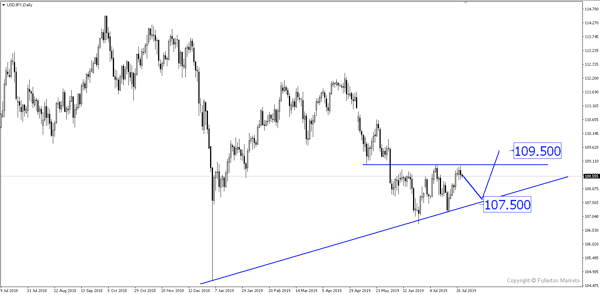

As Fed’s cut is most likely a preventive move and insurance against risk, Fed may not open doors for additional easing. USD/JPY could fall initially after rate cut is announced before rising.

The market has already fully priced in a 25bps cut tonight after Fed’s June monetary policy announcement for the first time since the financial crisis. The odds of a 50bps cut was scaled back after Fed committee member John Williams walked back on his comments for a more aggressive policy move.

The main reasons for the rate cut are mainly due to:

1) US-China trade tensions

2) Slowing global growth

US-China trade talks seemed to spur little hope of resolution as uncertainties continue to rise. US data mixed with Q2 GDP last week showed signs of slowdown coming in at 2.1%, a drop from 3.1%. NFP rebounded strongly in June while core retail sales increased at a faster pace.

Fed’s evaluation of the risks to the economy is weighing more heavily than it did before. As a result, it is set to act pre-emptively due to fears of the impact that trade tensions could have, rather than as a reaction to the actual fallout

With the rate cut of 25bps fully priced in, market should be looking at both the votes during the monetary policy announcement and Powell’s press conference.

1) If there are FOMC voters who are favouring further easing and Powell does not discount more rate cuts, dollar could fall. Vice versa, if Powell keeps tight-lipped on further action, dollar could rise.

2) If Powell were to be noncommittal to further easing and says that future rate moves will be data dependent, NFP this Friday will be the next market mover.

There are reasons to believe that the cut this time round could be an insurance cut against future risk. This will then mean that Fed is not as dovish as what market perceives.

USD/JPY could fall initially when the cut is announced but could shoot up higher if Powell confirms the insurance

Fullerton Markets Research Team

Your Committed Trading Partner