With Canada’s economy going strong, Governor Poloz may continue to monitor data and keep rate cuts on the table. CAD/JPY could rise but further upside could be limited.

Bank of Canada (BoC) is one of the few central banks left still keeping its neutral view on its economy. BoC is widely expected to keep rates unchanged at 1.75% tonight but the market is curious if Governor Poloz will hint at an October cut during its statement.

During the BoC’s last meeting, Governor Poloz said that the BoC will remain cautious amid the US-China trade tensions and global slowdown. Since then, the US-China trade war has worsened but Canada’s economy seems to be going strong.

Canada’s inflation is near central bank’s target, retail sales stagnated while manufacturing activity steadied. Lastly, GDP released last Friday hit nearly 4%, well above forecasts, although year-on-year gain is slightly lower.

Although the market is pricing in a 75% chance of a rate cut before the end of the year, we believe that Governor Poloz may choose to keep his neutral tone and continue to monitor data.

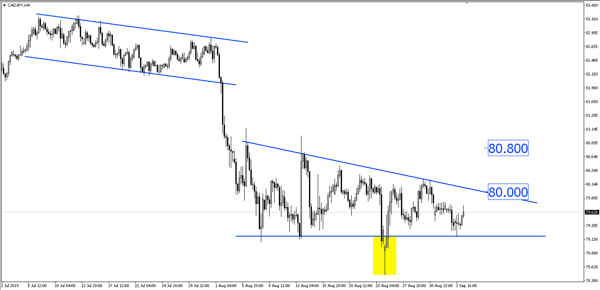

CAD/JPY could rise towards 80.00 once the rate statement is announced and whether it could go higher towards 80.80 will be dependent on whether Poloz keeps his neutral view or shifts towards dovishness.

Fullerton Markets Research Team

Your Committed Trading Partner