Despite a rebound in Canada’s employment, sluggish productivity and lower oil prices could cause BoC to lean towards dovishness. CAD/JPY could be a good pair for shorts.

- CAD was one of the stronger currencies last year against the greenback with a rise of 5% against dollar.

- However, it has weakened 0.6% against dollar so far this year due to trade relief, geopolitical tension and positive US economic data.

- Bank of Canada is expected to keep rates unchanged tonight though they may not be as bullish as at the previous meeting in December.

- Bank of Canada has kept its interest rate on hold for more than a year even as its peers move to cut rates and loosen monetary policy.

- Furthermore, in its previous meeting, Bank of Canada was very bullish after talking about the resilience of consumers and stabilisation in the global economy.

- Since then, Canada’s economy has weakened from consumer spending to the housing market.

- If Bank of Canada focuses on its weakness tonight, we could see CAD slide further.

- However, if Bank of Canada chooses to ignore weaknesses and stand by the resilience of the market, CAD will soar higher.

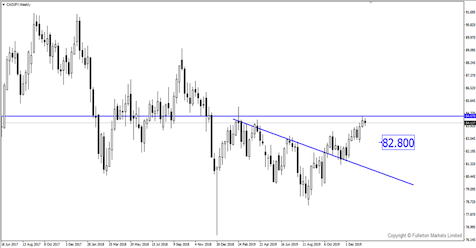

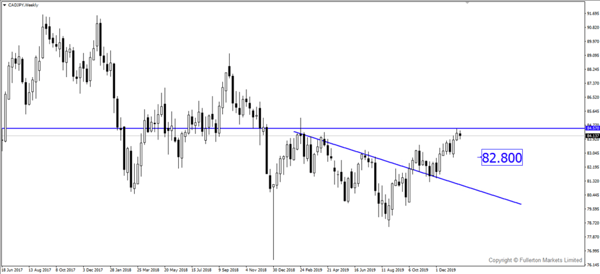

- CAD/JPY is currently at a very strong resistance and could head lower towards 82.80 if Bank of Canada is dovish tonight.

Fullerton Markets Research Team

Your Committed Trading Partner