RBNZ could hint that they are looking for further easing amidst escalation of the US-China trade war. NZD/JPY could fall further.

RBNZ is widely expected to cut rates tomorrow by 25bps to 1.25%. The market has already fully priced in the rate cut tomorrow but the forward guidance could potentially hurt New Zealand dollar which could include another cut in November to 1%.

New Zealand’s business and consumer confidence remained weak, weighing on hiring and spending. This has led to growth slowing and inflation below the midpoint of RBNZ’s 1-3% target band.

Labour data for New Zealand will be out before the monetary policy and we believe that even if data surprises to the upside, it is not enough to stop RBNZ from cutting rates.

Lastly, there is an increased discussion on non-conventional easing such as bond purchases and negative rates as the historical low in interest rates would have limited effect in countering a crisis.

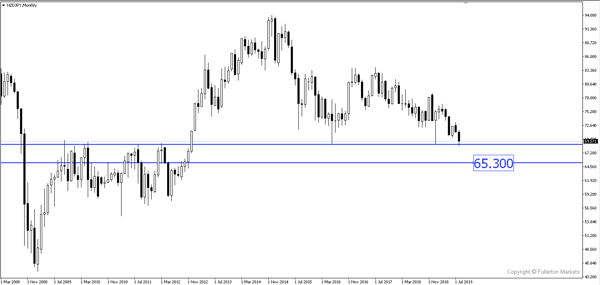

NZD/JPY could break the 68.90 historical support which opens doors to 65.30 price level.

Fullerton Markets Research Team

Your Committed Trading Partner