With US-China trade tensions easing, improvement in US data and limited cases of Coronavirus in the US, Fed has no urgency to change its stance. Short EUR/USD?

- FOMC is expected to keep rates unchanged at 1.50-1.75% without making any major changes to the statement.

- US indexes rebounded on Tuesday following solid US economic data and mixed earnings as markets kept a watchful eye on developments in the China virus outbreak.

- The coronavirus outbreak in China has spread globally with 6,062 reported cases, of which eight are in the US and Canada.

- Fed may downplay the extent of damage done by the coronavirus outbreak until its next meeting when more data is available.

- Furthermore, with the US-China phase one deal signed and upbeat US companies’ earnings, Fed may be inclined to keep its monetary policy on hold.

- The FOMC press conference will be vital as questions on the coronavirus’ impact on the US economy will definitely be on the list.

- Lastly, issues on liquidity will require answers from Fed as it has been providing large liquidity through purchases of Treasury bills. This can be seen as a Quantitative Easing (QE) lite and the market will want to know what Fed’s next course of action will be.

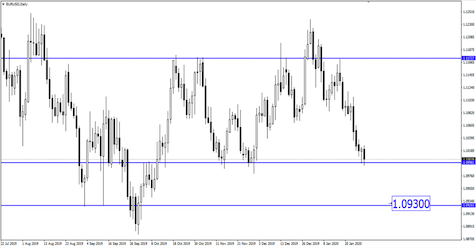

- EUR/USD is currently holding at its support and if it breaks after a bullish FOMC, this pair may fall lower towards 1.0930.

Fullerton Markets Research Team

Your Committed Trading Partner