ECB is likely to tweak its policy language amidst Italy’s budget crisis, short EUR/USD?

ECB is widely expected to keep its interest unchanged tonight, but will likely acknowledge the worsening growth outlook for its economy.

- ECB will reaffirm the market that its asset purchases are set to end this year without delay.

- They will also undoubtedly comment on the PMI data released earlier this week which showed growth in the eurozone losing more momentum than expected. This was the slowest quarterly growth in more than two years.

- On the political side, the EU has taken the unprecedented step of rejecting Italy’s budget. Furthermore, the face-off between Rome and Brussels could add pressure in the Italian bond market which in turn, would pressure the euro further.

- The market will also be curious to hear ECB President Draghi’s thoughts on core inflation in the eurozone after he mentioned that there was a “vigorous” pick-up in core inflation at last month’s meeting.

- We feel that tonight Draghi will be left with no choice but to admit the downside risk EU is facing and this could be dovish to euro.

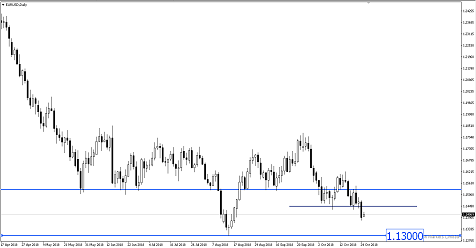

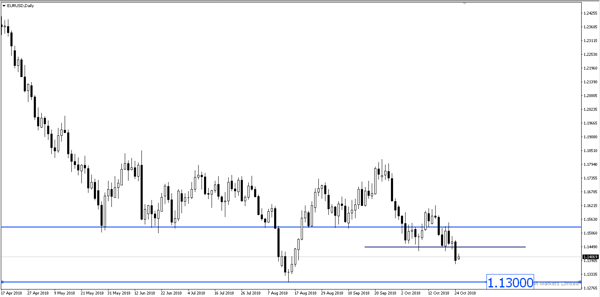

- We saw EUR/USD break the 1.1430 support after the PMI data missed forecast by a huge margin. With a dovish ECB meeting tonight, we could expect EUR/USD to test the 1.1300 level.

Fullerton Markets Research Team

Your Committed Trading Partner