With risk sentiment shifting towards risk-off, a stronger NFP will only provide a better short entry. USD/JPY could break critical support at the 106.80 price level.

After Trump’s fresh twitter tariff volley against China last night, market sentiment has shifted to risk-off mode. Investors are buying up safe havens amidst the escalation of the US-China trade war. With China’s retaliation expected, this could further worsen the current situation.

US jobs data will be released tonight, and the markets are expecting NFP results to be steady. The employment report last month came in at 224k versus a 160k forecast. The market is forecasting 164k this tonight which may not have a significant impact on dollar. ADP non-farm, which is an indicator of how employment will perform, came in strong at 156k versus the previous month’s 112k. This could mean that employment report tonight could be around the 170k range.

Unless NFP tonight surpasses market expectations by a huge mile, we should expect the sell-off in dollar to continue and any rally could be a good opportunity for a short entry.

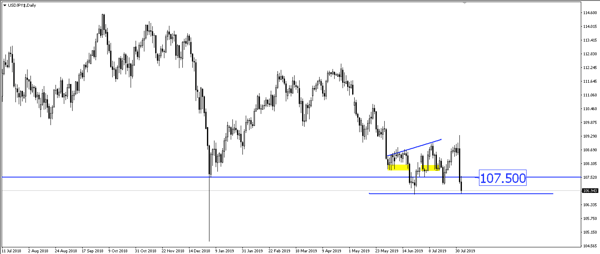

USD/JPY is currently holding at the 106.80 price level which is a critical support. We expect this pair to retest 107.50 price level if data meets market expectations before short-sellers join in.

Fullerton Markets Research Team

Your Committed Trading Partner