Given that the ADP employment report shows an uptick, we might see NFP surprise the market to the upside. Long USD/JPY?

Investors are looking forward to NFP later tonight at 9.30pm (SGT) after a dovish Fed caused a sell-off in dollar. US economic data has been softer for the past few weeks with inflation, economic activity and consumer sentiment missing expectations. The labour market was the only saving grace and surprised the market in December with a 312k eye-popping result.

Due to the US government shutdown from December to January that lasted 35 days, more than 400k furloughed federal workers will be classified as “unemployed on temporary layoff” according to the US Bureau of Labour Statistics. This will impact unemployment which we believe could tick up to 4%.

The ADP employment report on Wednesday came out at 213k versus the expected 180k. Although not the most accurate gauge of the actual employment number, it is however the only one we have. Furthermore, December’s employment data which came in at 312k is likely to weigh on the data tonight. With that, we believe that NFP could still surprise the market coming in at the 200k region.

Lastly, we expect average hourly earnings to be in line with consensus as we believe that the labour market tightness will continue to be the main driver for a higher wage growth.

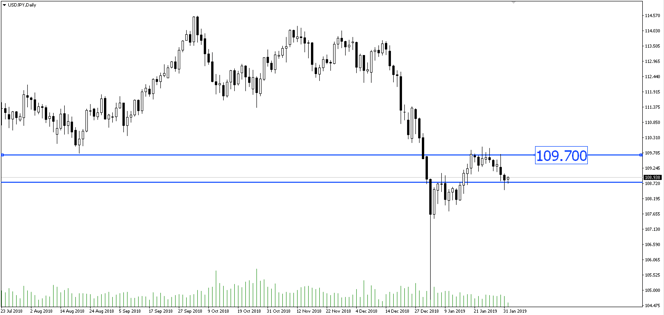

USD/JPY previously fell and hit our target of 108.70 during FOMC. The price seemed to be unable to break the support at 108.70. We believe that a stronger NFP could push this pair towards to the 109.70 price region.

.png?width=600&name=Sneak%20Peek%2020190201%20(EN).png)

Fullerton Markets Research Team

Your Committed Trading Partner