US Debt Ceiling Resolution May Offer Temporary Boost to Stock Market

- May 29, 2023

- | Fullerton Markets

The resolution of the US government's debt ceiling negotiations has brought a collective sigh of relief to global markets. The news of the agreement has sparked a rebound in the stock market, with...

Stocks Pick of The Week - Tech Companies Boost Sentiment Amid Debt-Ceiling Concerns

- May 29, 2023

- | Fullerton Research

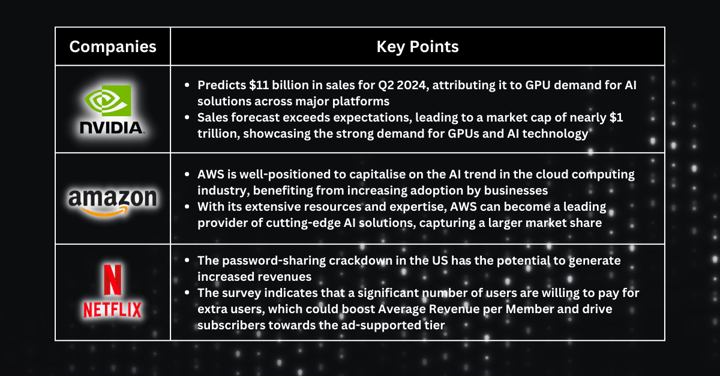

The Nasdaq Composite experienced a notable surge following Nvidia's strong sales forecast, fueled by the increasing demand for artificial intelligence technology. Nvidia's stock soared by 25%,...

Debt Ceiling Crisis Casts Shadow on Sentiment as Fear Gauge Signals Further Stock Declines

- May 22, 2023

- | Fullerton Markets

Negotiations on the US debt ceiling are set to continue Monday, with federal leaders working towards a resolution as the risk of a potential default looms. President Joe Biden and House Speaker Kevin...

Stocks Pick of The Week - Debt Ceiling Progress Spurs Market Focus on Tech Sector

- May 22, 2023

- | Fullerton Research

Investors have been seeking confirmation that debt-ceiling negotiations are progressing positively following President Biden's optimistic remarks to avoid a default. The sentiment was boosted as...

Uncertainty Looms as Debt Ceiling Talks and Federal Reserve Policy Offer No Clear Direction

- May 15, 2023

- | Fullerton Markets

Last week, Wall Street was sparked by concern after the University of Michigan released a preliminary reading showing a six-month low in consumer sentiment.

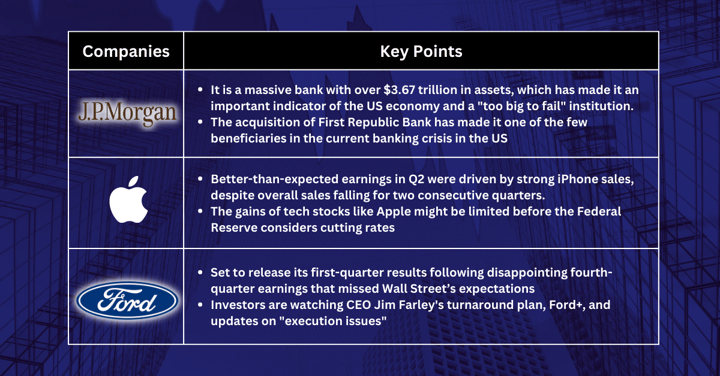

Stocks Pick of The Week - Market Jitters As US Debt Ceiling and Banking Crisis Loom, But Three Safe Haven Stocks Remain Available

- May 15, 2023

- | Fullerton Research

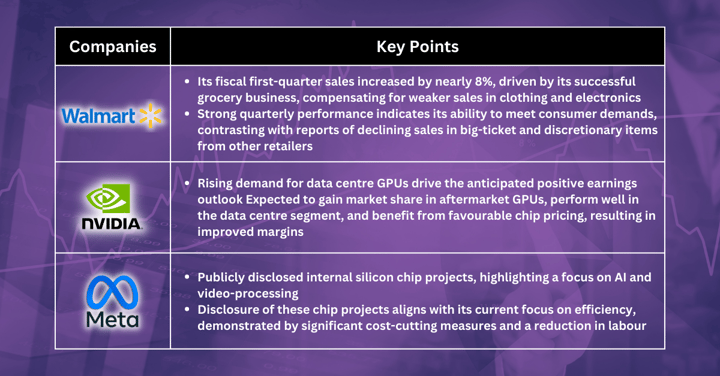

Despite upbeat economic data, stocks faced resistance due to disappointing corporate performance and persistent banking fears. In April, wholesale prices in the US rose 0.2% for the month,...

US CPI Report This Week Will Reveal What Fed Will Do In June

- May 8, 2023

- | Fullerton Markets

Investor attention this week turns to April’s consumer price index out Wednesday, followed by the producer price index on Thursday. Financial markets are hoping that it continues to remain subdued....

Stocks Pick of The Week - Banking Crisis Aids Federal Reserve’s Mission of Cooling Down Economy

- May 8, 2023

- | Fullerton Research

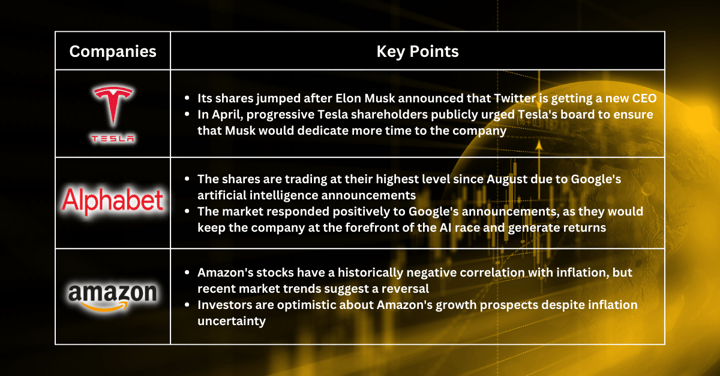

The recent dip in the Dow Jones Industrial Average amid concerns over banking issues does not necessarily foreshadow a significant drop below multi-year lows. The volatility in the banking sector...

Fed Meeting This Week To Provide With Clues On Whether It’s The Last Hike

- May 2, 2023

- | Fullerton Markets

Wall Street is gearing up for the Federal Reserve's policy-setting committee meeting this week, with a decision on whether to raise the benchmark Fed funds rate expected to be released on Wednesday.