Editor’s Note: This post was originally published on September 14, 2018, and has been updated for accuracy and comprehensiveness, adding new information on mirror trading and social trading.

Trading currencies can be done in two ways: manual trading and copy trading. There are certainly advantages to both.

But you might have also heard about mirror trading and social trading in Forex, which can be quite confusing, especially to newcomers. Since failure to differentiate one from the other can lead you to make questionable decisions, you should widen your knowledge.

You see, in the world of Forex, it's not just about definitions but what goes into a specific trading style. Because disinformation might cost you a good part of your portfolio, it pays to be in the know.

So let us dive into the argument and see what we may discover.

What is manual trading?

This trading process involves human decision-making to enter and exit trades. While computer programs are used to set automated indicators, human input is required to execute trades.

Pros:

- Less susceptible to shifts or unpredictable economic events, climates, and trends

- Can outperform computation logic if a trader has the experience, knowledge, and intuition of a seasoned trader

- Humans have the ability to analyse and predict human variables that influence supply and demand

Cons:

- Limited by different human attributes--emotions, computational power, time constraints, etc.

- May require long periods of monitoring the Forex market

- Trading is limited to when a trader is awake and has access to their trading platform

What is copy trading?

Copy trading is a method in the financial markets that automatically connects a portion of your portfolio to a trader you choose to copy. Whatever trades a signal provider opens will be automatically copied to your account. The same is true for any and all of their actions in the future.

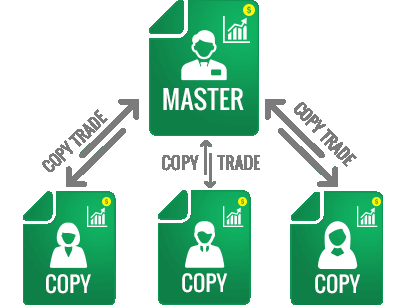

In this process, the master or the strategy provider trades while the followers will mimic the trades automatically.

How does copy trading work?

Check out the diagram below.

The Flow of Copy Trading

And here's a simple scenario to further explain how a copy trading system works.

Person A = copy trader

Person B = specific trader to be copied

A allocates a certain amount in their funds to copy the trades of B. If B allocates 10% to trade, A's account automatically allocates the same percentage so that the same trade is made.

Copy trading is a simpler alternative to mirror trading.

Pros:

- Trade like a pro even with minimal Forex knowledge

- No need to monitor trades all day

- Never miss a trade when you mimic a full-time trader

- Choose a trader whose trading strategy suits your style

- Learn by watching professional Forex masters at work

- Understand the psychological mindset behind each trade from seasoned traders

- Diversify your portfolio while keeping risks to a minimum

Cons:

- There's always a risk that a master will make a bad trade, resulting in a bad outcome for a copy trader

- You can't make discretionary choices

- You might not gain the experience or learn to become an independent trader if you choose to simply follow

“Give a man a fish and you feed him for a day. Teach a man to fish and you feed him for a lifetime.” - This Chinese proverb stands true even to this day.

If you follow someone else’s trade through copy trading, you could profit but you should never assume that he/she will continue to trade forever. Of course, the counter to this is to find other good or even better traders to copy.

What is mirror trading?

This basically works the same as copy trading where you copy trades executed by experienced and successful currency investors in real time.

The difference is that you won't be duplicating trades of a single signal provider. Rather, algorithmic strategies from top traders are applied to execute trades automatically. This is why most mirror trading platforms will ask you to look at a list of trading criteria rather than a list of traders.

Trades are fully automated. You can't choose which trader or signals to follow.

Pros:

- Minimal time commitment. After the initial setup, trade decisions are handled by algorithms and executed automatically.

- Reduced risk since trading decisions are based on multiple traders instead of a single trader

- Expect consistent results since mirror trading platforms are required to present a profitability track record that spans a year or so.

- Emotions are taken out of the trading equation.

Cons:

- Algorithm-based trading is not for beginners.

- There's a fear of the unknown since most algorithms used in mirror trading are not disclosed.

What is social trading?

Although this was inspired by mirror trading, social trading is actually a mix between mirror and copy trading.

This form of investment is based on collaboration and observation. Social traders share market research much like users in social networks would. You then have the option to use the information as the basis for your next trade.

Various platforms allow users to follow a top-ranked trader, post their own updates on the platform's social news feed, and comment on other posts.

Pros:

- More autonomy over trading decisions, reducing risks that come with automated trading

- Engage with other traders within a community which will help in your overall Forex trading strategies

- Access to relevant information and specific data for a more comprehensive investment decision

Cons:

- Decision-making can be time-consuming because you need to constantly monitor market information before you enter a trade.

- You may miss some opportunities that automated trades don’t, especially if you take a break from the market.

- Overly hyped news and collective sentiments within a community may result in impulsive trading.

- Some trading platforms have transparency issues. An individual trader can post misleading information about a specific trade or investment they’ve made.

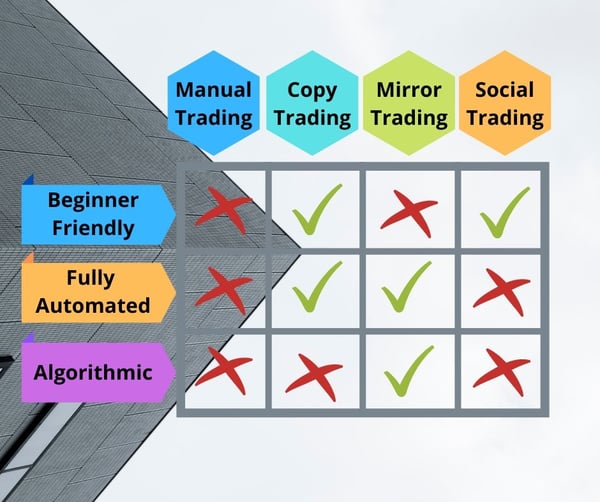

How does each trading style compare based on 3 fundamental criteria?

Manual Trading vs Copy Trading vs Mirror Trading vs Social Trading: Which One Is Best for You?

It really depends on your preference.

For someone who prefers to do things hands-on, then manual trading would most likely be your cup of tea.

For full-time professionals who do not have the luxury of time to even look at charts but want to earn passive income, copy trading could be just for you.

Here’s how you can narrow down your options.

Manual trading is best if you:

- Have a high-risk tolerance and a well-funded trading account

- Are willing to learn the intricacies of the Forex market through experience, whether good or bad

- Are one of the professional traders and experts who know currency trading like the back of your hand

If you are someone who prefers to learn how to fish (remember the Chinese proverb?), you can learn different trading strategies to fit your schedule.

If you are working full-time and are unable to look at the charts every hour, you can swing trade which requires only occasional monitoring. Once you master the skills of manual trading in Forex, it is something that nobody can take away from you. And the skills only get better over time.

Copy trading is best if you:

- Are a newbie in Forex investing who want to learn trading fundamentals from experts by watching them in action

- Are not a full-time trader or don't have the luxury of time to constantly follow market trends or monitor price action

- Tend to make emotionally driven decisions, resulting in poor choices

- Lack the discipline to stick to your trading plan or strategy

- Want to never miss a trade by mimicking a full-time trader

- Want to take a hands-off approach in managing your portfolio. You'd rather leave that responsibility to a professional trader.

- Prefer to avoid the possibility of your trades turning against you when you're asleep or when you forget to set a stop-loss order

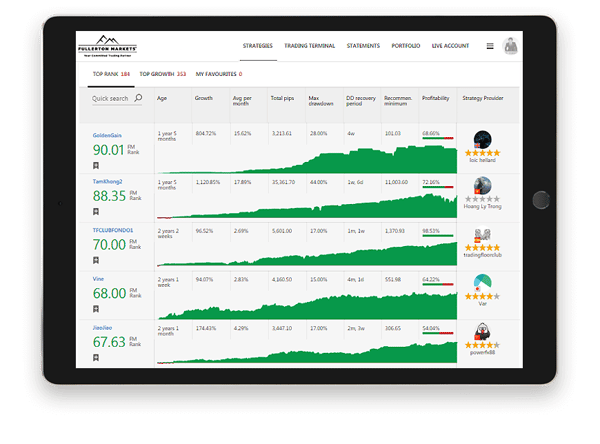

Successful copy trading lies in choosing the best trader to copy. On Fullerton Markets' CopyPip platform, you'll have access to our top traders who are ranked according to performance, growth, and other criteria.

If you click on a trader's portfolio, you'll see their performance over a certain period. We provide you with all pertinent data to help you choose a professional trader that will suit your trading plans. You may even refer to the weekly tips that we share to help you make smarter decisions and select profitable Strategy Providers to copy on CopyPip.

If you click on a trader's portfolio, you'll see their performance over a certain period. We provide you with all pertinent data to help you choose a professional trader that will suit your trading plans. You may even refer to the weekly tips that we share to help you make smarter decisions and select profitable Strategy Providers to copy on CopyPip.

Mirror trading is best if you:

- Understand the algorithms used in Forex trading, allowing you to make better-informed decisions when you enter a trade

- Understand and value how expert traders react to macroeconomic data and trends

- Want to eliminate the risk of your tendency to enter trades based on emotions

- Want a hands-off approach when trading currencies

Social trading is best if you:

- Are new to foreign exchange investing and want to learn the basics

- Only trade as a hobby, while enjoying the community of traders you're in

- Prefer to study market sentiments and trends instead of doing technical analysis

- Don't want to be bound by the restrictions of fully automated trading

Which trading style closely describes the trader in you?

Regardless of which camp you belong to, there is no stopping you from venturing to the other side. After all, the grass always seems to be greener on the other side of the fence.

It’s also common for a copy trader to become a manual trader. Combined with the information and data from social trading, you have every opportunity to excel. In fact, we highly encourage it.

So, go ahead! Join a community of traders where you can share ideas and discuss what's new in the Forex market.

Then, guided by what you learned from kindred individuals, trade manually with Fullerton Markets, or leverage our copy trading platform, CopyPip, and enjoy the advantages you will get when you copy trade with us.

Ready to grow your wealth in the world's largest financial market? No better place to start than right here with us! Begin trading with Fullerton Markets today by opening an account:

You might be interested in: How to Choose the Appropriate Lot Size to Trade