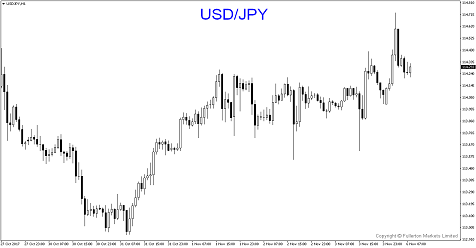

US unemployment rate lowest in 17 years! Good to buy USD/JPY?

Powell could support the dollar in the long run

President Donald Trump officially nominated Fed Governor Jerome Powell to become head of the US central bank last week. Powell’s policy is largely expected to be a continuation of Yellen’s cautious monetary policy. Powell has worked with Yellen for the past five years, backing her direction on monetary policy.

FX markets had typically viewed Powell as bearish for the dollar because he has supported gradual interest rates rise, rather than more aggressive moves. The dollar sold off on reports that he will be the next chair. The spread between 5- and 30-year yields fell last week to 81 bps, marking the flattest curve since November 2007, right before the start of the global financial crisis. The difference between 2- and 10-year maturities was also the smallest in a decade.

In our view, we believe Powell would be a net positive for the greenback in the long run. If a more hawkish candidate such as John Taylor is nominated, more aggressive pace of interest rate hikes could benefit the dollar more. However, it will also harm the recovery of the US economy. When that happens, the dollar will ultimately weaken. Powell’s nomination ensured continuity in the Fed’s monetary policy. That means the Fed is on track to hike interest rates multiple times next year and the unwinding of the balance sheet remains on track.

US unemployment rate suggests Fed could raise the rate more aggressively

US nonfarm payrolls advanced 261k in October, missing the earlier estimate of 313k. The unemployment rate unexpectedly declined to 4.1%, the lowest in 17 years! The low unemployment rate indicates the Fed could act more hawkish in the next few months. We forecast the US interest rates will be 1.75% by March next year, with two rate hikes in December and March.

Among all the economic indicators, our correlation analysis showed the US unemployment rate carried the highest correlation with the Fed funds rate.

Our Picks

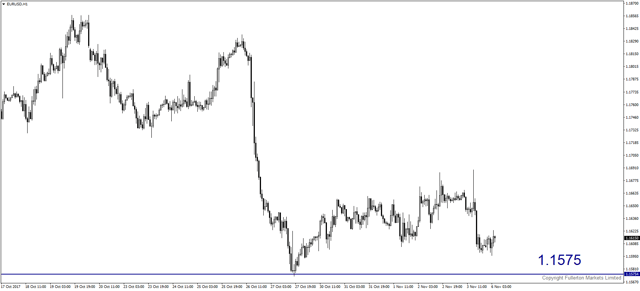

EUR/USD – Slightly bearish.

This pair may drop to 1.1575 as the dollar may climb after the strong US jobs report.

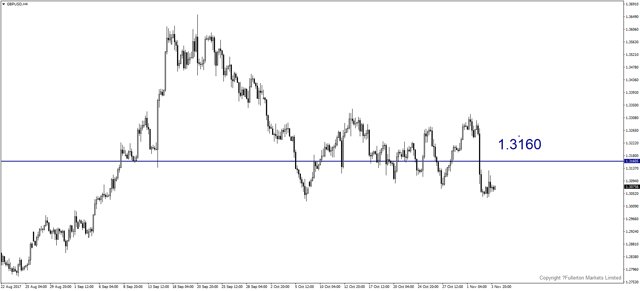

GBP/USD – Slightly bullish.

Selling off could be a bit exaggerated last week. We anticipate some technical rebound in this pair this week. GBP/USD may climb towards 1.3160.

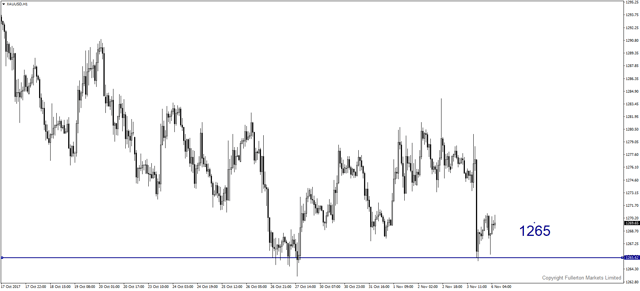

XAU/USD (Gold) – Slightly bearish.

Outlook on Fed’s continuous tightening should pressure gold lower. We expect price to fall towards 1265 this week.

Top News This Week (GMT+8 time zone)

Australia: OCR rate decision. Tuesday 7th November, 11.30am.

We expect RBA to keep the rate unchanged at 1.5%.

New Zealand: Rate decision. Thursday 9th November, 4am.

We expect RBNZ to keep the rate unchanged at 1.75%.

Fullerton Markets Research Team

Your Committed Trading Partner