BoE may surprise the market by keeping future interest rates unchanged, Short GBPCAD?

Bank of England (BoE) is widely expected to raise UK interest rates to 0.75% tonight. However, sterling continues to dip ahead of the rate decision as there are uncertainties over whether BoE will have more rate hikes in the near future or worst yet - no increase this time round.

Tonight’s rate announcement comes with a speech by Governor Carney who will update the market on the path of rate hikes for UK. If BoE were to raise rates tonight, this is the first time since the financial crisis in 2011 that UK interest rates is above 0.5%.

There are three scenarios that could happen:

- BoE raise interest rates and warn that further interest rates are in the pipeline for late this year or next.

If this happens, BoE could be using purely stronger economic data to justify for the rate hike though the data so far was mixed. Unemployment rate fell, jobs opening increase and inflation are well above BoE’s target. On the other hand, wage growth remains tepid, investments fell, and household debt is reaching unsustainable levels.

- BoE raise interest rates but hint that the next rate hike will be a long time from now.

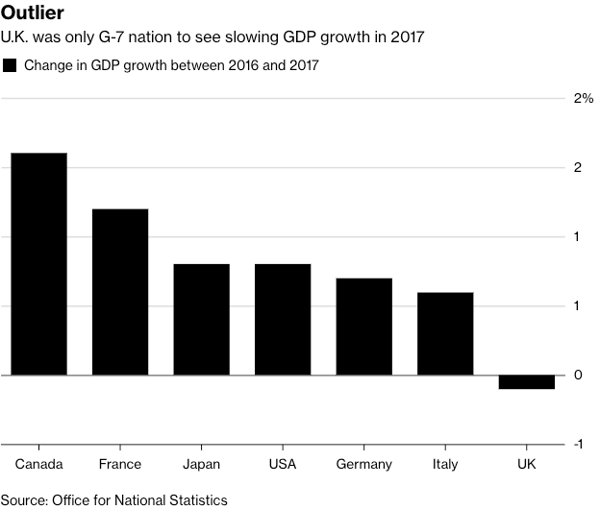

If this happens, BoE could be adopting a wait-and-see approach in regard to Brexit negotiations which is still huge risk to UK. Furthermore, UK’s economy is still fragile as economic data has shown that there is no reason to raise rates this time round. UK’s growth slowed as well as compared to the G-7 nations. We could see sterling gains fizzled quickly as investor takes profit from the initial rise.

Source: Bloomberg

- BoE keep its interest rate unchanged.

This is the worst-case scenario, and, in our opinion, it is very unlikely. However, given household debt are hitting the ceiling, a hold on the rate hike tonight could allow further easing of household debt until the end of the year. Furthermore, consumers and businesses also require assurance that policy tightening from BoE is modest and gradual so as not to harm growth. Lastly, BoE might not want to risk raising interest rates ahead of an uncertain outcome of Brexit negotiations and the possibility of no deal.

In our opinion, we feel that the second scenario is most likely based on a few reasons:

- Economic data is strong enough to command a rate hike with retail sales strengthened since May and inflation rate already above BoE’s 2% target.

- The next eight months will see Brexit negotiations come to a climax and the inevitable period of uncertainty means this is the MPC’s last opportunity to raise rates for some time.

- If BoE were to hold rates unchanged, this could cause sterling to weaken to record levels which isn’t their intention.

All in all, Bank of England is caught between a rock and a hard place. UK’s economic data for the last few months could not justify a rate hike tonight entirely, but the market has already start to price in August’s rate rise to the bank. Brexit outcome which remains in an uncertain phase will continue to weigh on sterling.

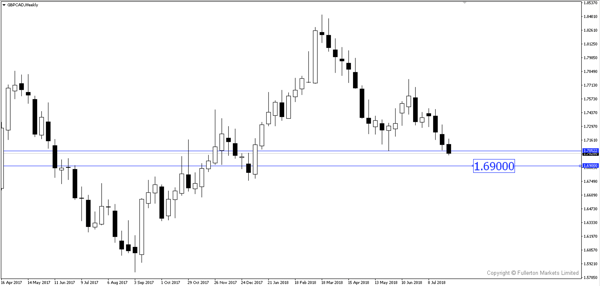

GBP/CAD has been bearish for close to 4 weeks as price breaks the support at 1.7040 price level. The last time GBP/CAD hit those levels was in May 2018. We could see further downside to 1.6900 levels if BoE’s comments tonight is dovish.

Fullerton Markets Research Team

Your Committed Trading Partner